International | May 13 2009

By Rudi Filapek-Vandyck

China’s economic data releases this week have provided a rude awakening for optimists counting on a quick and swift recovery after earlier promising signals in March and April. Without exception, all economic data released this week have come in below market expectations, if not below previously released data. This is somewhat compensated by positive indications about money growth and fixed asset investments.

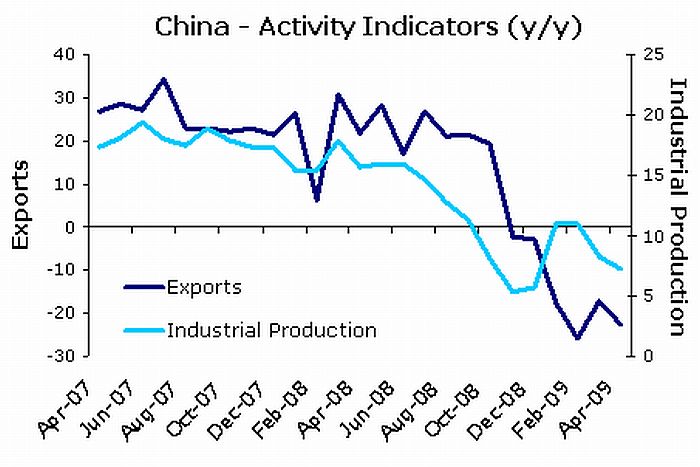

Today’s retail sales and industrial production for April both disappointed. Nominal retail sales grew 14.8% year-on-year in April, up only marginally from an earlier reported 14.7% rise in March. One could take the slight rise in real sales as a positive as the Chinese CPI declined slightly in the month. However, no such spin is possible for today’s released industrial production growth for April. Instead of a further improvement on top of the surprise 8.3% IP growth for March, April’s figure came out 1ppt lower at 7.3% compared with April last year.

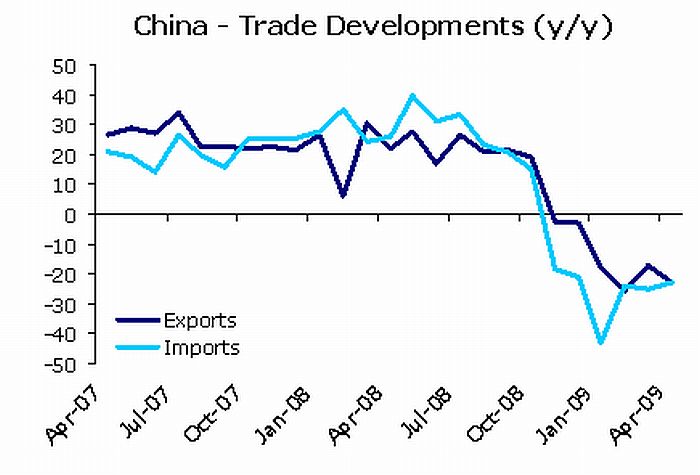

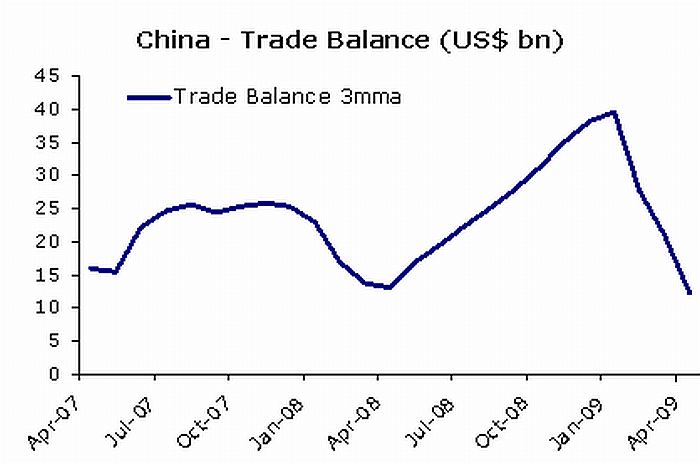

It also became clear that China’s trade data remain weak, especially exports. Data released this morning show Chinese exports declined by 22.6% in April compared with a year ago. This follows on from an earlier reported 17.1% contraction in March. Again, investors and economists had expected an improvement, but got a negative surprise instead. Imports in April declined by 23.0%, which was slightly better than March. The monthly trade surplus fell by one-third to US$12.9bn.

The one standout release this week was China’s fixed asset investments which rose in April, climbing 30.5% (y/y) from 28.6% in March. As pointed out by economists at ANZ Bank, the Chinese government’s move to ease capital requirements for borrowing to invest in fixed assets such as transportation, property, coal and information technology is likely to remain an important growth driver this year.

Earlier this week, Chinese data confirmed money growth continues to rise, but credit growth is moderating. M2 growth rose to a record 26.0% (y/y) in April from 25.5% in March. M1 growth also rose to 17.5% from 17.0% a month earlier. Chinese banks issued CNY592bn of new loans in April, a third of the record CNY1.89 tn in March. Yuan lending in the first four months has already exceeded the government’s minimum of CNY5 tn for all of 2009.

ANZ economists responded earlier this week as follows to the disappointing trade data: [the weaker than expected trade data] “underscore the difficult external environment facing not only China but all of emerging Asia. As we have noted elsewhere, growth will have to be domestic led this year. China, with large state involvement in the real economy as well as financial sector, is better placed than most countries to generate such domestic demand and elevate growth in 2009 (and 2010 if necessary). Going forward, we would expect relatively weak outturns for the trade balance as domestic demand gradually strengthens imports and weak external demand continues to weigh down export growth.”

Data released this week revealed China’s trade surplus declined by one-third in April. The monthly trade surplus fell to US$12.9bn last month, down from US$18.6bn in March and well below the US$40bn per month range seen last year.

On Monday, the National Bureau of Statistics (NBS) stated China’s consumer price index (CPI), fell 1.5% year on year in April, while producer prices (PPI) fell 6.6% in April.

(All charts courtesy of ANZ Bank. Readers who read this story through a third party channel might not be able to see the charts included in this story).