FYI | Dec 04 2006

By Greg Peel

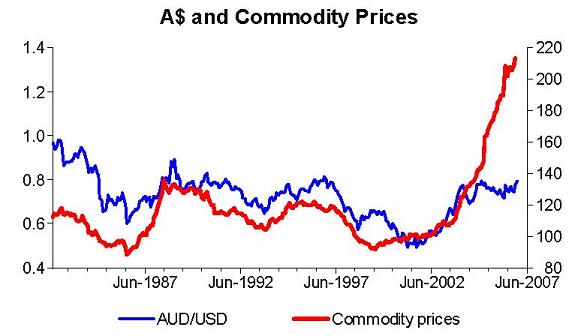

A picture paints a thousand words, so check this out:

(Chart: TD Securities)

If the correlation over the last decade is anything to go by, between the Aussie and commodity prices, the Aussie would be at US$1.30. This chart has been provided by TD Securities, and shows the RBA commodity index based specifically on Aussie exports, rather than the global CRB index, which is not as relevant. The lack of correlation prior to 1987 was at a time when commodities were unwanted and Aussie interest rates were through the roof.

On the basis of this chart, TD Securities suggests the Aussie is a “very strong” Buy. However, the economists are not silly enough to suggest $1.30 is a given target. They tip US$0.84 for the first quarter of 2007, given they assume lower US interest rates next year.

They do, however, suggest the market is mispricing the currency. Price increases in zinc, wool, beef and veal have driven the index of late, and Australian export commodity prices are “still massively strong”. Is it because of a burgeoning current account deficit, or excessive foreign debt? Unlikely, says TD, as these factors have been largely ignored for some time.

Analysts at GSJB Were are calling the US dollar “very weak”, but they are tipping the Aussie to go down, not up. While this seems odd, Weres believes industrial momentum is slowing in Australia, and that commodity prices will be flat to lower in 2007. The tip is for an Aussie of US$0.74 next quarter, and US$0.72 in 12 months.

Part of the Aussie’s problem is the deterioration in capital flows, says Weres. The Future Fund and local superannuation funds are likely to increase their offshore exposures. Another factor is the increasing maturity profile on Aussie dollar uridashi debt.

Say what?

Uridashi debt refers to the famous “yen carry trade”. Investors look to “arbitrage” the interest rate differential between Japan and Australia by borrowing in yen and investing in Aussie-denominated debt securities. This works as long as the currency differential remains relatively stable, and if short maturities are not being sought then less Aussie dollars are being “bought” in the short term.

TD Securities famously likes to stick its neck out, and we don’t call chief strategist Stephen Koukoulas “Kooky” for nothing. But Kooky has been calling Aussie interest rates higher on inflation pressure for some time now – apparently correctly – and he is not in the 2007 easing school. This adds weight to his AUD view, commodities aside.

Weres is influenced heavily by the views of the global strategists at big brother Goldman Sachs, providing thus a slightly more “top-down” approach, before local considerations kick in.

It will remain to be seen who’s right.