FYI | Dec 14 2006

By Rudi Filapek-Vandyck

Once upon a blue Monday, I’d write finance stories in an office building only a few meters away from the radio journalists’ corner. On a regular basis we would hear our colleagues broadcast sentences that admittedly sounded good, but they were, in essence, incorrect. This despite the radio team defending their case with: we have to summarise it in two sentences while making it understandable for a non-educated audience.

We still thought it had to be correct. After a while we simply gave up. Finance is not something to be summarised in two sentences, unless one wants to stick to reciting pure facts such as the market closed higher and the Qantas board has accepted a revised privatisation proposal.

Don’t get us started about television…

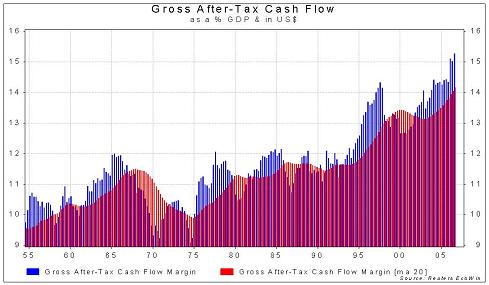

I’ll now pass on the baton to our friends at GaveKal, freethinkers at heart and similarly annoyed by what is being broadcast on a sheer daily basis. Says GaveKal: “Rarely a day goes by without some pundit coming on to CNBC and arguing that stocks today should be sold because a) margins are at record highs and b) margins will have to “revert to the mean”. Needless to say, this annoys us to no end, for it smacks of either lazy thinking and lack of work, or worse, downright intellectual dishonesty.”

(Silent nod from the colleagues on the left).

To support their case, GaveKal has produced a chart representing the gross after tax cash flow margins of the total US corporate sector. No need to argue there’s no mean reverting trend apparent.

In another report, GaveKal analysts had a deeper look into the US job growth figures, suggesting there may be a simple reason why current employment figures are no longer accurate. This is, by the way, a point of public debate which pretty much has been going on for a few years now. Main point of the critics: society has changed over the past few years with more micro-companies being set up while numbers of self-employed and consultants grow continuously – these people do not show up in the official employer-generated surveys.

GaveKal argues investors and economists should give more attention to the household employment surveys instead of continuing to rely on the published US payroll figures. On this basis the analysts report US job creation over the past 12 months has been running at a monthly rate of 246,000 instead of the 149,000 reported by the media.

The household survey attracts much less attention because it is much more volatile, says GaveKal, but then “the household survey probably gives a clearer picture of the US economy: firstly, because it is better at gauging new business formation, immigration and self-employment; secondly because such factors become evermore important as the US transitions towards a post-industrial economy”.

Why the nitpicking?

GaveKal: “Recall the long debate back in 2003-04 about the “jobless recovery”. At the end of 2003, the household survey suggested that the US economy was expanding strongly, with 2 million new jobs created in calendar 2003. The payroll survey, by contrast, showed no growth at all that year. As a result, investors who watched the payroll survey believed that the US economy was still mired in recession and that Fed funds would remain at 1% forever. Those of us who trusted the household survey predicted an economic boom. And the boom is still on.”

It goes without saying GaveKal is very positive about US equities in the year ahead.