Commodities | May 15 2009

By Chris Shaw

As evidenced by its underperformance relative to the likes of copper, investors have been bearish on the aluminium price outlook for some time. Analysts at Barclays Capital note since prices hit an all-time real low and smelters began to make large production cuts, market sentiment towards the metal has been improving.

This improvement in sentiment has some in the market suggesting the low in prices has been seen and better times are ahead, especially given consumer hedging activity is another possible signal of some buying to support prices. Barclays analysts points out the large levels of short positions in the metal offers scope for prices to be squeezed higher if these positions need to be covered.

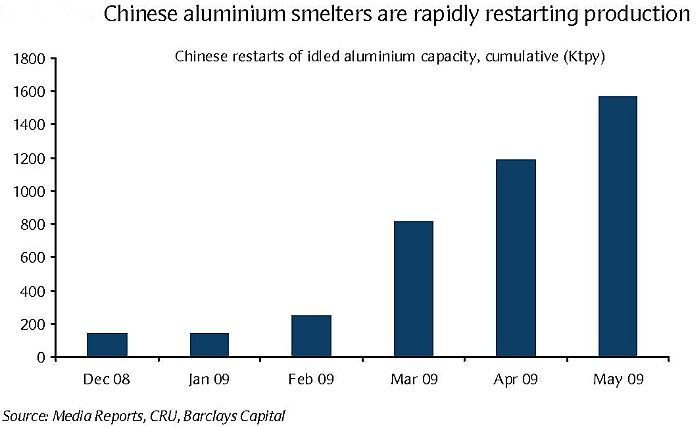

But even allowing for these factors Barclays finds sufficient reasons to remain bearish, not least because the recent rally in metals prices generally now has aluminium the most dislocated from fundamentals at present. As well, some production in China is being restarted and the analysts expect this trend will undo previous attempts at improving the supply/demand balance in the market.

While official production data don’t yet show a big increase in output, Barclays suggests this will soon be revealed given the ramp-ups are already flowing through to higher alumina prices and an increase in alumina imports into China. On the group’s estimates as much as 1.6 million tonnes per year of capacity is in the process of being restarted, while a further 500,000 tonnes per year is being fired up.

This creates scope for the Chinese market to move into a large surplus, meaning imports would decline and the excess metal would likely find its way into LME markets where stocks have already been rising despite the strength of Chinese buying in recent months.

Such a trend is bad news for prices as it means there is an unseen source of supply ready to be released onto the market if prices rise, which should be enough to cap any rallies. Add in the fact the market is entering its usual northern summer slowdown and Barclays sees it as increasingly likely aluminium prices hit a new cycle low sometime in the next few months.