PR NewsWire | Oct 03 2024

|

- During the week of the Night Race, Singapore saw over 20% surge in international visitors,[1] driving close to 30% spending uplift

- High-net-worth visitors[2] surged by over 70%, contributing to approximately 70% increase in their overall spending

- Visa cardholders from Hong Kong SAR, Japan, Malaysia, Australia, U.K., U.S. accounted for over 40% of tourism spend

- SMBs in Singapore saw a spending increase of over 50% by tourists [3]

SINGAPORE, Oct. 3, 2024 /PRNewswire/ — As Singapore’s premier international night racing event concludes, Visa, the world leader in digital payments, today unveiled data[4] demonstrating consumer behaviours and spending patterns during the week-long September spectacle.

The data, based on Visa’s analysis of the spending patterns of Visa cardholders during the this period, revealed over 20% increase in international visitors, driving close to a 30% uplift in overall spending.[5] Such benefits extended to local spending as well, resulting in a 10% uplift during the same period.[6]

High-Octane Night Race Demonstrates International Appeal

Top spending and international visitor trends identified in relation to Visa cardholders include:

- A substantial influx of visitors from the region and beyond: Hong Kong SAR led the way with more than 200% increase in traveller spending. Australia and U.K. also saw a significant uplift in spending (approximately 80%), while U.S. (over 40%), Japan (over 40%) and Malaysia (60%) also saw substantial growth. Together, these markets accounted for over 40% of tourism spend during the race week.

- Spending preferences by country: Top spending by visitors from Hong Kong SAR were on Entertainment (over 40% of spend) and Restaurants (over 15%). Visitors from U.S., U.K., Australia and Japan spent mainly on Restaurants (over 20%) and Lodging (over 20%). Malaysian visitors spent on Entertainment (over 25%), Retail goods (approximately 15%), and Restaurants (over 10%).

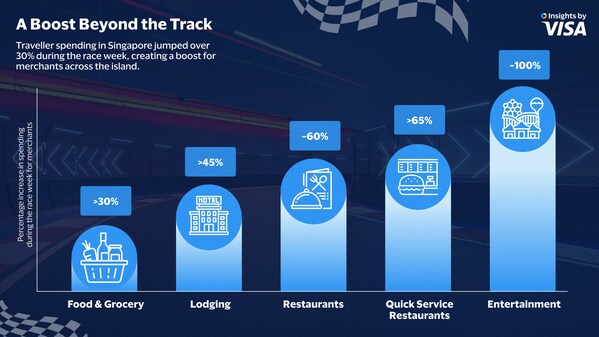

- Biggest spending increase in F&B and Lodging: The top merchant categories were Entertainment with an uplift of nearly 100%, followed by Quick Service Restaurants (approximately 70%), Restaurants (approximately 60%), Lodging (over 45%), and Food & Grocery (over 30%).

- Notable increase in high-net-worth visitors and spend: The Night Race week saw over 70% surge in high-net-worth visitors, contributing to approximately 70% increase in overall spending from this segment.

- Small and medium businesses benefit from tourism boost: The local small and medium business sector in Singapore experienced an approximate 10% spending uplift. This translates to a spending increase of over 50% by tourists.

- Boost in spending beyond core event area: Surrounding areas like Kallang experienced over 170% uplift in spending, followed by Outram (over 120%), Rochor (close to 80%) and Downtown Core (over 90%).

Decoding Visitor Behaviours: Capturing the Impact of Event-Driven Tourism

To assess the overall impact of major international events on the local business landscape, Visa takes a closer look at visitor behaviours, spending patterns and payment preferences by Visa cardholders during the Night Race week:

- Tracking the payments journey: For Lodging, hotels near the event location experienced 70-100% increase in spending, underscoring the premium visitors place on convenience and proximity to the action. In the Restaurants sector, bars and lounges experienced a 130% increase while restaurant chains specialising in Asian cuisine and Singaporean seafood saw an approximately 30-40% increase. In the Entertainment category, bay-facing recreational services saw over 150% uplift, while tourism attractions across the city-state saw more than 90% increase in spending.

- Singapore after dark – nightlife surges from midnight to dawn: Singapore’s late-night activities[7] experienced a significant boost, particularly in dining and entertainment. Visitors increased their spending by approximately 130% across common nightlife spots such as Chinatown, Bayfront Subzone, City Hall and Clarke Quay between 12 a.m. to 6 a.m. Of which, late-night dining saw a surge of approximately 170% in spending, while entertainment venues enjoyed an uplift of over 130% during these hours.

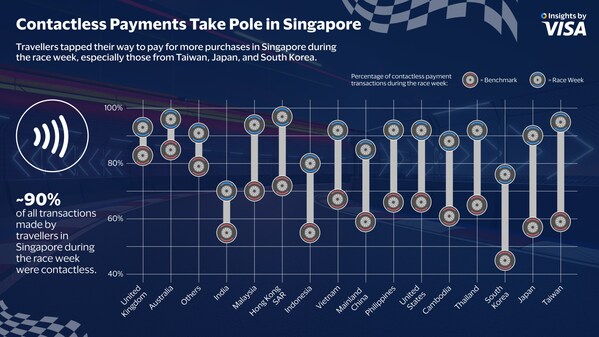

- Contactless payments gain foothold: Visitors from Taiwan (over 35%), Japan (over 30%) and South Korea (close to 30%) showed a notable increase in their contactless payment usage[8] while in Singapore. This highlights the growing global adoption of contactless technology, facilitated by Singapore’s advanced digital payments infrastructure.

Unlocking New Opportunities in Travel with Data Insights

Prateek Sanghi, Head of Visa Consulting and Analytics, Asia Pacific, said: "Our findings underscore Singapore’s enduring appeal as a premier destination for major international events, as demonstrated by the marked increase in visitors and spending across various sectors during the Night Race week. Visa’s data unlocks more than just current trends, providing valuable insights into tourist behaviour and spending patterns, which can empower businesses of all sizes to not only maximise opportunities during event-driven travel periods but also predict future behaviours."

Visa’s payments data, consulting services and in-house data science capabilities enable organisations with key insights to help them enhance visitor experiences, optimise business strategies, and drive economic growth across the travel and commerce ecosystem.

| [1] Identified by non-resident cardholders making in-person transactions within Singapore. [2] Identified as Visa Infinite and Visa Signature cardholders for all countries except Japan (Visa Gold and Visa Platinum in Japan). [3] Figures compare the period from September 14 to 22, 2024, with the weekly average of the preceding 12 months. [4] Based on anonymised aggregated transaction data from September 14 to 22, 2024. [5] Figures compare the period from September 14 to 22, 2024, with the weekly average of the preceding 12 months. [6] Figures compare the period from September 14 to 22, 2024, with the weekly average of the preceding 3 months. [7] Figures compare the period from September 14 to 22, 2024, between 12 a.m. to 6 a.m. daily with the weekly average of the preceding 12 months. [8] Figures compare the period of September 14 to 20, 2024, of contactless transactions with the weekly average of the preceding 12 months. Contactless payment usage is defined by the percentage of total face-to-face transactions made using contactless technology. |

About Visa

Visa (NYSE: V) is a world leader in digital payments, facilitating transactions between consumers, merchants, financial institutions and government entities across more than 200 countries and territories. Our mission is to connect the world through the most innovative, convenient, reliable and secure payments network, enabling individuals, businesses and economies to thrive. We believe that economies that include everyone everywhere, uplift everyone everywhere and see access as foundational to the future of money movement. Learn more at Visa.com.