Feature Stories | Jul 11 2006

By Greg Peel

For the purpose of this article, all gold prices will be quoted in US dollars per ounce.

1. Gold and the Global Economy

In 1999, the gold price hit a low of $252.80. The last time gold had seen these levels was in 1979 when the low price was $216.55 around the start of the last great gold rally.

Gold rally? The current record high in the gold price is $850 achieved in 1980. That was some rally. Particularly when you consider gold started the seventies under $50.

In the seventies the US was forced to expand credit in order to pay for the Vietnamese war. At the same time the great oil supply shocks were precipitated by OPEC. Inflation was left to fend for itself. Inflation reached 13%.

Fast forward to early 2002, at which point the US dollar index hit its most recent high of 120.24. Gold was still trading under $300. The Fed had decided that credit expansion was once again required to pull the US out of the ashes of the tech wreck. The Fed funds rate was eased down from 6.5% to hit 1% by mid 2003.

In July 2004, policy changed. Thus began the now infamous seventeen step tightening phase. The US dollar has responded as it should by falling from its index high of 120.24 to 85.02 before tightening began. It rallied once more, but began to fade. At this point the state of the overblown US current account deficit and the cost of the Iraq war began to weigh on sentiment. Then Katrina hit. The dollar fell to an index low of 80.59 at the beginning of 2005. It has never been under 80.00.

As the dollar slid from its high to its low gold did what it was supposed to do and began a measured rally. There were a few ups and downs along the way, but when the US dollar bottomed out gold was fiddling around the low $400s.

Then something strange happened.

As the Fed tightened and finally the dollar responded, the gold price was reluctant to fall. When US dollar hit a post-low peak of 92.39 on the index in late 2005, the gold price had actually rallied to $500. And then it was on for young and old.

Why did gold suddenly "decouple" from the US dollar? Historically the two have an inverse correlation in the high nineties.

The inverse relationship between gold and the US dollar does not arise purely because the benchmark gold price is denominated in US dollars. It arises because of the "safe haven" battle between the two. The gold standard for benchmarking currencies was abandoned in the seventies and was replaced with the US dollar. Thus the US dollar became the preferred global safe haven.

Whereas gold is a tangible "precious" metal, the US dollar is only a "fiat" asset. This means its value is merely underwritten by the US Federal Reserve and controlled by it as well. At the end of the day, it’s paper. The reason the world was happy to accept this paper as a benchmark for all currency exchanges is because it represents a manifestation of the greatest economy on earth.

It is a lot easier to move intangible US dollars around than it is to try and buy and sell with cumbersome gold. However, the perceived value of US dollars with respect to the world’s other currencies (and hence economies) ebbs and flows over time. If the perception is that the US economy is in trouble, the dollar falls. If the dollar falls, the world is inclined to retreat to the former safe haven of gold. Hence the inverse relationship.

More dramatically, if the world is under some sort of cataclysmic threat, for example a possible nuclear war, investors run back to gold because in the aftermath you’re going to look pretty silly standing there with bits of paper backed by an economy that no longer exists. However, gold is gold is gold.

So comfortable with the US dollar as a benchmark had the world become that, over time, global dramas began to affect less and less volatility in the gold price. Iraq’s invasion of Kuwait was one of the last attempts at traditional flight to the safety of gold, but that proved short-lived. Between then and now, the only real blip has been in the lead up to Y2K (remember when all the planes were going to fall out of the sky?) when gold rallied from around $250 to $325 very smartly. As it turned out to be the greatest non-event in the history of mankind, gold slipped away once more.

When planes hit the World Trade Centre the gold price barely blinked.

So returning to our question, why did the gold price decouple from the US dollar in 2005? What made the world suddenly want to buy gold when the US dollar was rising?

The first explanation offered is that of global inflation. In theory, gold is a hedge against inflation. This is because, once again, gold is gold is gold. If the value of a fiat currency is falling, then having your savings in gold protects them from devaluation. This means as inflation rises, so too should gold. Gold hit its 1980 peak when inflation was at double-digit levels.

Having enjoyed a period of very minimal inflation, moping around the 2% level, the world got a wake up call when China began to do its thing. The price of every commodity rose spectacularly, and the most critical of those was oil. A high oil price equals high inflation. No two ways about it, just look at the 70s-80s.

But where was the actual inflation? It wasn’t registering anywhere. The reason why it wasn’t registering anywhere is because China may have been vacuuming up every commodity under the sun but in return it was flooding the world with ever cheaper finished goods. The deflationary effect of the great Chinese manufacturing explosion offset the inflationary effect of spectacular price rises in all commodities including oil.

Economists relaxed. Inflation? Nothing to worry about.

Just about everybody underestimated China’s impact, however. Although the commodity super-cycle theory was born – that which suggests commodity prices will make a secular shift to historically higher prices – the "cycle" part of the theory still implied that commodity supply would catch up with demand soon and prices would settle down once more, albeit at historically higher levels.

It hasn’t happened.

Decades of underinvestment in capacity was harshly exposed as further problems of infrastructure, disputes and rising costs served to ensure supply was really struggling. And still demand kept rising. From China, India, Brazil, Russia and elsewhere in the emerging world. Economists were expecting higher prices would set off demand destruction, but it has not eventuated.

When the gold price decoupled clearly one of the reasons was fear of rising global inflation. But then we hit a conundrum. The US set about combating the inflation threat by continuingly tightening rates. This has the effect of making the US dollar more valuable an investment, and hence its value rises. When the US dollar rises, the price of gold should fall. But gold is a hedge against inflation.

Thus one of the reasons the gold price was able to rally in 2005 is due to inflation fears. The US dollar may have been rising as well, but only on the back of conspicuous Fed tightening. But in late 2005, another strange thing happened. Despite further tightening, the US dollar began to fall once more.

One reason for this is that Europe began to raise rates as well, and Japan began to talk about it. The benchmark measures of the US dollar are its value against the euro and the yen. However, the more influential reason was that the world was becoming increasingly concerned with "global imbalances".

The US is running the greatest current account deficit in its history – a deficit which has the more alarmed of economists warning of a cataclysmic collapse of the US dollar, and subsequently the whole world economy. The reason the current account deficit is this bad is because Americans have spent while a great proportion of the world has saved.

One of the longest periods of economic growth in American history has made its inhabitants wealthy and sent them on a consumption binge. More and more imports have flooded in to the US while fewer exports have left its shores. In the meantime, the inhabitants of Asia, the Middle East and even Europe have been minding their pennies. Where to lodge these hard-earned savings? Why in the safest haven of all, of course – the US.

The world has been buying US financial and non-financial assets with their ears pinned back. Foreign buying of US Treasuries has made America debtor to the world.

China has copped a lot of the blame. Parochial US congressmen have been baying for protection against the world’s fastest growing economy. Protectionism is one of the greatest global economy killers of them all. But the truth is, China’s surplus with the US represents only about a sixth of the US deficit. China, alone, is not the problem.

The amount of US debt, and fears surrounding the amount of US debt, were influential in the US dollar index peaking at 92.39 in late 2005 and heading south once more, towards 83.88. The Fed was raising rates because of inflation fears, but the dollar was falling. As far as gold is concerned, this was a red rag to a bull.

When gold breached $500 for the second time in 2006, there was no looking back. It did a bit of work around $550, and then went into lunar orbit.

As a result of US economic fears, the rest of the world was deciding, or at least alluding to the fact, that overinvestment in US assets was unacceptable and the time had come in today’s increasingly global world (I know that sounds redundant but you get my drift) to diversify holdings into other currencies. Into yen, into euro, and into gold.

Although there hasn’t been an enormous rush of central bank gold buying, merely talking about it has the same effect.

Inflation, US current account deficit, asset diversification – three reasons why gold became extraordinarily popular again.

Underlying these economic considerations was yet another factor: geopolitical crises. Gold may have become less of a safety flight asset over the years in times of political turmoil, but once its star had been reborn there was nothing going on in the world to suggest that buying gold was in any way misguided.

The War in Iraq. The War on Terror. Nigerian insurgency. South American nationalism. The breakdown of peace (if there ever was any) in the Middle East. And the latest biggie – Iranian nuclear ambitions.

The world has become an increasingly scary place, particularly as the three most influential world religions square off against each other. What might happen next? Who knows, but better put some money into to gold before the you know what hits the you know what.

And while we’re at it, throw in global warming. Fact or fiction? Perhaps you should ask the residents of New Orleans. Whether or not consensus scientific opinion is misguided, there is nobody left in this world who can remember weather conditions being quite as extreme. Global warming is a global wildcard.

Combine all these factors, and it really isn’t that hard to see why gold seemed to suddenly take off in price and catch everyone by surprise. But surprise gave way to astonishment when the gold price waved good bye to $500 at the start of 2006 and rocketed past $700.

Clearly there was something else at play.

2. One of the Greatest Marketing Ploys of All Time

Last month, the World Gold Council announced that gold miners Agnico-Eagle Mines, Cambior, Coeur D’Alene Mines, Eldorado Gold, Goldcorp, IAM Gold and Kinross had joined the WGC. Between them, the companies represent 5% of world gold production. The WGC now boasts 24 members from across North and South America, Asia and Africa including names like Newmont, AngloAshanti and Gold Fields. The only "Australian" member is the Australian subsidiary of Canada’s Barrick Gold.

The members of the WGC represent 38% of world gold production.

The WGC was founded in 1987 with the "aim to stimulate and maximise the demand for and holding of gold by consumers, investors, industry and the official sector". As well as undertaking marketing initiatives to drive demand, the WGC is also instrumental in "working to lower regulatory barriers to the widespread ownership of gold products, helping to develop distribution systems and promoting the role of gold as a reserve asset in the official sector".

In short, the WGC is gold’s PR company.

Why does gold need marketing? It’s not like it’s some "new product". The Egyptians cottoned on to it a few thousand years ago, as did the Incas and others. If there has been one single commodity every human being in the history of mankind has coveted it would be gold.

In 1987 gold was trading around the $400s, having flirted earlier in the decade with levels above $800. Like any faltering product, gold needed a bit of a relaunch. Inflation was still pretty rampant, the stock market had quadrupled in the decade, there were troubles afoot in the communist world – why wasn’t gold enjoying its rightful place?

Whatever marketing strategy the WGC came up with in those early days, it didn’t work. Gold began to lose its relevance, and so began the slow decline down to the low of 1999 in the mid $200s. A few ponytails must have been given the chop, one would think.

Apart from not being able to sell much gold, gold miners were also faced with the problem that even if they did, at such prices the mining of gold was uneconomical in many cases. No point in mining it for a loss – might as well give the game away. Mines closed.

Price aside, one of the biggest problems with investing in gold is just how to go about it. You can buy gold jewellery, but jewellery’s value is somewhat inflated by its aesthetic appeal. You can buy gold coins, or gold bars, but if you really wanted to get stuck into gold investment you’d have to be able to store these safely, and that’s a bit of a worry. Besides, they weigh a ton.

The biggest market for gold to date has been the futures market, most specifically on Comex in New York. So big that many multiples of the world’s actual gold supply is traded daily for cash settlement. But futures have their problems.

Futures markets are considered risky, and volatile, and frequented by speculative cowboys. They are leveraged instruments, thus adding to the risk, require deposits, margin calls and contract rollovers. Futures markets are not for the faint-hearted, nor the inexperienced. So risky are futures markets considered, that many large global public fund managers are not even allowed to touch them. They also represent a paper holding, an IOU if you will, and that hardly makes them a safe haven in comparison to holding US dollar paper.

Alternatively you could buy the publicly listed shares of gold miners. Gold mining shares exhibit varying degrees of correlation with the gold price, depending on how "pure" they are. In fact, through "hedging" strategies gold miners can actually achieve leverage that ensures their share prices can provide capital returns better than the subsequent movement in the price of gold.

Conversely, if miners are using "hedging" strategies to actually "hedge" (and this, in itself, is a sensible risk management approach), returns on mining shares can be far less than the returns from gold. A bit disappointing really. But not nearly as disappointing as when gold miners exploit their capacity to engage in hedging strategies that actually become punting strategies and find themselves in bankruptcy. One of the world’s biggest miners – Sons of Gwalia – did exactly that.

So buying shares in gold miners in not a great solution either.

This was what the WGC was facing as we entered the new millennium. Gold had lost its popularity, and even if it did become popular again, it was really just too hard to acquire.

Then one day, someone had a brainwave. What about an exchange traded fund?

Exchange traded funds already existed for other assets, particularly baskets of shares. The concept was simple – instead of buying a portfolio of shares in several companies the investor could buy shares in a fund that would "track" the value of that portfolio and save a lot of mucking around.

It wasn’t too much of a stretch to adopt this concept for gold. Instead of buying gold directly you simply bought shares in a fund whose value tracked that of the gold price. While you would still only own "shares", a form of paper, that paper would be backed by actual gold that would be put aside for you in a vault somewhere in the world. It was the next best thing.

The Australian Stock Exchange is credited with listing the world’s first gold-backed instrument that can be considered an exchange traded fund, or ETF. However, it wasn’t until the WGC cottoned on to the idea that the impact of gold ETFs was fully felt.

In November 2004, the first gold ETF was listed in the US. It was established by the WGC and backed by State Street. In the first three days, 30 million shares were purchased. Each share represented one tenth of one ounce of gold. It was believed that most of the buyers were "first-time investors".

In February 2005, the second gold EFT was launched by Barclays Global Investors. After two days Barclays held 35,000 ounces of gold in trust for shareholders. At that stage the WGC was holding 4.8 million ounces (152 tonnes). A bit of competition did nothing to upset the demand for gold EFTs. It only fuelled further interest.

For the first time, gold was "easy" to buy and own. The mindset of the WGC members was that if gold was indeed easy to buy, more people would want to buy it.

Now there’s a conundrum. If an investor buys an asset simply because he now can, and as such pushes the price up, does that imply the asset must have been undervalued all along, or that any price increase represents non-existent value? Whether or not the WGC members ever lay awake at night pondering this question is by the by. The introduction of ETFs in the US was, in hindsight, a masterpiece of timing.

As soon as the Barclays ETF was listed the gold price decoupled from the US dollar and started its upward push. Why? Well for all the reasons discussed previously. Or could it be? No. Surely the gold price didn’t decouple from the US dollar simply because of the existence of ETFs?

When the Chairman of the WGC, Pierre Lassonde, president of the world’s largest goldminer, Newmont Mining Corporation, welcomed the new members last month, he said:

"The past three years have been excellent for the gold industry as the price of gold has more than doubled from its secular low. The WGC has without a doubt made a significant contribution to this success. The creation of the first Exchange Traded Gold Fund (ETF) has been a phenomenal success, with close to 500 tonnes of gold taken up by investors in approximately 18 months. This is the most significant new gold product to ever come to the market. We plan to expand the reach of this product by listing it on multiple stock exchanges".

So Pierre stopped short of suggesting the ETF should take all the credit, and, realistically, one wonders whether or not the ETF product would have enjoyed anything like the same level of success if it wasn’t for all the factors besetting the world as previously discussed. But put the two together, and one and one equals three.

The reality is that when gold broke a level of resistance at $440 in mid-2005 it then sailed through $500, raced through $600, and had the turbo-charger engaged in a mere two-month sprint through $700. Long-standing gold watchers had quite simply never seen anything like it, and even those who remembered 1980 were gobsmacked. On May 12 2006, the London PM spot gold fix was $725.

Tough break if you bought gold at $725. One week later the US CPI figure came out for April and it was worse than expected. The fear was that the Fed would not cease tightening rates as hoped. Pretty soon everything, including gold, collapsed.

Back to the conundrum again. The CPI figure represented increased inflation – just what everyone was worried about. In theory that should be bullish for the gold price. But it also implied another rate rise from the Fed, and that would be bullish for the US dollar. Within the month gold had retraced in a virtual freefall back to under $550.

Okay, the US dollar did rally when the Fed tightened in June. But surely a little 25bps was not enough to send panic through the gold market? Inflation was confirmed, the current account deficit hadn’t improved, Iran hadn’t backed down.

The reason the gold price collapsed was due to that little word called "bubble". In twenty years the gold price had not run up so high, so fast. Stock markets had bubbled up and burst on more than one occasion in between, but it wasn’t the nature of gold over recent decades to do the same thing. However, this time it was different.

By turning gold into a "share" by virtue of ETFs the WGC and cohorts had opened the doors for the gold market to act just like the share market. The share market is a place where stocks can trade up or down on momentum alone without any specific change in fundamentals. The herd mentality ensures that when a stock is hot, it’s really hot. Many an investor has been burnt by jumping into a rising stock for the simple reason of not wanting to miss out. Many of these investors may never have traded shares before.

And so it came to pass with gold. In early 2006, the gold market was trading up on momentum alone. Sure, the fundamentals were there, but they had been there for a while. There was nothing to specifically drive the price at such a pace other than excited talk around the water cooler.

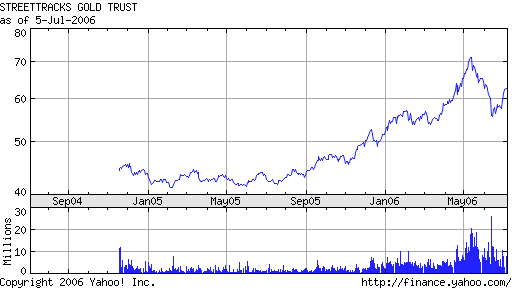

And the fact that gold was easy to buy. A quick glance at the chart below shows just how the blow-off rally in gold was fuelled by a surge in ETF trade. This particular graph is of the WGC ETF.

Now that the bubble has burst one thing is certain – there are plenty of investors out there who won’t be venturing back into gold thank you very much. But more experienced gold traders and asset allocators are glad we’ve had a correction. Corrections of this type are very healthy for bull markets. It shakes out all the nervous money and puts a lid back on volatility, at least for a while.

And there is very little to indicate we are not in a bull market for gold. Let’s go back to our checklist.

Are there still inflation concerns – yes. Is the US still running a massive current account deficit – yes. Is there still talk from central banks around the world about diversifying out of the US dollar – yes. Is there still geopolitical tension – oh yes indeed – Iran’s threatening to pull out of nuclear negotiations and what was that that just landed in the Sea of Japan?

To top it off, the Fed is still tipped to raise rates again this year, but most commentators believe 2007 will see a pause in policy and maybe even the first easing. The reason is that the US economy is predicted to slow, if for no other reason that the oil price looks like continuing higher. This will bring pressure to bear on the US dollar.

Given this climate alone, the gold price should rise, but what will ensure its rise is investment in ETFs. Initially ETFs saw a wave of investment from those who had wanted to buy gold for a long time, and from hedge funds and smaller managed funds that were looking for a "new" asset with which to diversify their portfolios given the troubles of the US economy. But now:

"It is gratifying that despite significant price volatility in Q1’06, in almost all categories, buyers are spending more on gold than they were a year ago. Particularly pleasing is the increasing interest from institutional investors with strong evidence that much of the demand is coming from new long term investors who are rediscovering the lasting diversification attributes of holding gold within a portfolio", said James Burton, Chief Executive of the WGC.

"[ETFs] will become targets of the world’s major investment funds within three to five years once the four established products have absorbed about 3,000 tons in demand", said Chris Thompson, former chairman of the WGC.

"For small pension funds, the ETFs are already large enough to warrant their attention. But the major funds want to see a track-record and liquidity. These types of funds are always the last to adopt new products. But they’ll come. We need to have about 3,000 tons of gold in the vaults. That’s what I hope for." Thompson again.

But larger funds are already rumoured to have tested the water. 109 tonnes worth of gold ETFs were bought in the first quarter of 2006, much of it supposedly long term investment. The volume on the downswing was not nearly as much as the volume on the up. And as the previous chart shows, peak volume was reached when gold bottomed out in June. There is currently some 500 tonnes of gold backed by ETFs.

Where could the gold price go?

Seth Foreman is the Senior Analyst for Investment Relations at Newmont:

"As our President, Pierre Lassonde, recently indicated, he believes gold will eventually have three zeros in its price – he just doesn’t know if the first number will be a one, two or five."

Now if I was the Senior Analyst for Investor relations at Newmont, I would probably talk my book as well, but Seth does go on to say, more soberly:

"We anticipate that gold will extend the general trend exhibited by the metal over the past several months and will continue to rise. Newmont isn’t alone in being bullish of gold either. S&P Equity Research Services recently raised their estimate for the year-end gold price to $710 per ounce, and well-respected industry consultant GFMS indicated that the 1980 high of $850 per ounce could be challenged."

What might stop it?

Well for one thing, when commodity prices rise, supply is supposed to eventually catch up to demand and we cycle down once more. However, it has been noted that supply of all commodities has had a tough time trying to even demand growth at all. Is gold any different? No.

World gold production is actually falling.

Consider also: The Russian and Chinese central banks have both recently indicated they would like to buy more gold. Russia, which has just surpassed Saudi Arabia as the world’s greatest oil producer would like to move its holdings from 5% to 10% of reserves. The European average is 15%.

China, which needs no further qualification, only holds 1% of its reserves in gold.

There are currently only 16 nations on earth that actually hold more gold than the WGC gold ETF alone.

Bullish, I think.