Commodities | Jul 12 2006

By Greg Peel

On Monday FN Arena brought news that China’s three biggest stainless steel producers were planning to cut production by 20% in the northern summer due to a high nickel price having wiped out margins. They did this last year, and the nickel price fell 35%.

Nickel has stolen the limelight away from copper and zinc, having been the outstanding performer in the second quarter and kicking off the third in a similar vein. The price is now well above the previous May high, and the correction is all but forgotten.

Is it a bubble? Will it end in tears? Certainly the Chinese factor could well weigh on speculative sentiment. But then it hasn’t yet.

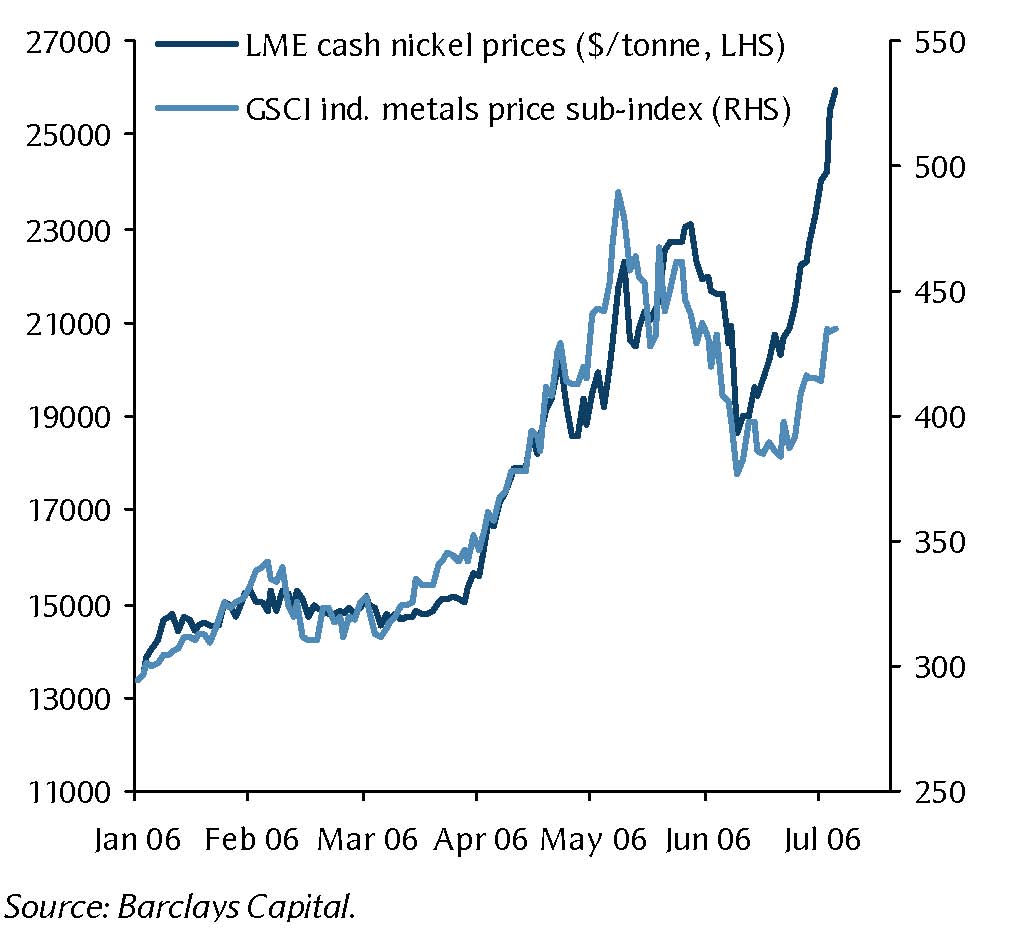

The LME nickel price rose 45% in the second quarter and a further 18% this month. From January 1, the nickel price has risen 117% compared to copper’s 109% and 77% for the GSCI metals index.

Barclays Capital points out that the nickel price is clearly a reflection of ever-tightening fundamentals. LME stocks have diminished rapidly in 2006 and currently represent only about three days forward cover. There is real concern from producers that they simply won’t get the nickel they need.

The stainless steel industry absorbs 70% of all nickel, and globally that industry is firing along. The US has successfully applied five price increases this year, notes Barclays. In Europe there is strong buying interest and longer and longer delivery times. It is only in Asia where momentum is slowing.

Barclays is not talking a price pullback. The analysts note that the nickel price is often considered a lead indicator for other metals, given its leverage to the steel industry. The LME inventories of copper and zinc are also rapidly declining and demand has not abated. Barclays infers that nickel could well drag the other metals up with it.