Commodities | Nov 23 2006

By Rudi Filapek-Vandyck

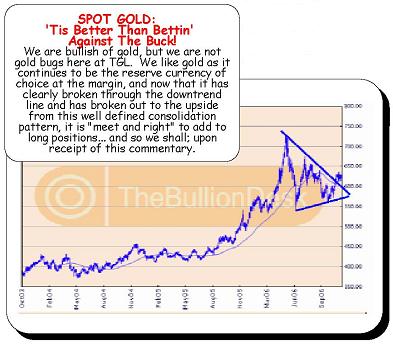

Time to buy gold? US-based trading guru Dennis Gartman certainly thinks so. In his latest update of daily The Gartman Letter, Dennis highlights the small overnight rise in the spot bullion price was sufficient to push gold outside its “well defined consolidation pattern”.

A bullish technical signal in combination with bullish fundamental signals make for a clear trading opportunity, Gartman suggests. He flags he will be adding to his already long position in the market.

Among the bullish signals mentioned in The Gartman Letter is a very strong demand from India as the marriage season begins in earnest. Gartman cites the World Gold Council reporting Indian jewellery demand in the third quarter was up 11.9% from a year ago. India ‘s gold imports were up 123% from a year ago in October, he adds.

Also, he believes the central banks are currently supporting the bullish picture as they have been selling more gold than usual recently and it has had a negligible impact on the spot price in the open market. In the past two weeks, three European central banks havesold 18.13 tonnes of gold, Gartman reports, adding that in order to meet the 400 tonnes allotted under the Washington Agreement, they normally only need to sell approximately 7.7 tonnes per week.

Gartman: “Normally, one might suggest that such sales would be depressive of gold, but instead, gold has taken these sales rather well, and has moved higher. We are reasonably impressed, and remain long of gold as a result.”