Commodities | Nov 29 2006

By Greg Peel

National Australia Bank has released its quarterly gold report for September. The analysts have forecast that the gold price will average at US$675/oz in 2007, a rise of 11% from the average established in the first nine months of this year of US$600/oz.

While this represents a sizeable rise, National points out that the base level has been lowered since the great post-May sell-off. At one stage, the analysts were tipping an average 2007 price of US$753/oz. One assumes this means all could change again come December. Nevertheless, National has made its case.

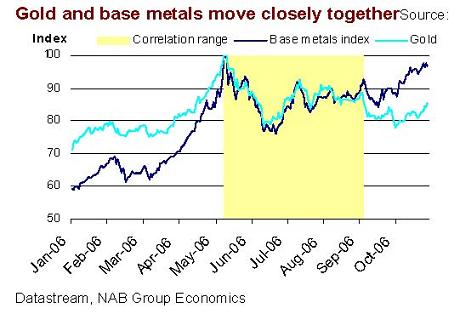

Between the May peak and the beginning of September, the gold price has moved in close correlation with base metal prices (see chart). The analysts maintain “there is little justification for this relationship”, given the industrial demand for gold is minimal at best.

(FNArena suspects the correlation had more to do with the sudden surge of investor interest in commodity instruments in late 2005/early 2006. When the bubble burst, all metal investments were affected, irrespective of their actual usage.)

Nevertheless, (and once European central banks got their selling out of the way) the gold price began to decouple in September-October as seasonal buying demand for gold returned from Asian jewellery makers. Jewellery demand represents about two-thirds of total gold demand.

The key to jewellery demand is reduced gold price volatility. This is considered more important than the absolute price. Given jewellery makers buy their gold and then spend time fashioning it into trinkets, it doesn’t pay to have the bottom fall out of the gold price. Nor is it safe to buy into a raging bull market, as high jewellery prices will also curb consumer demand, particularly if an obligatory wedding gift is forced upon an otherwise modestly remunerated Indian.

Therefore a combination of lower and more stable prices has served to renew interest in jewellery buying, after a drop of 18% in volume demand year-on-year. (Value actually increased by 15% due to the price increase).

National further notes Middle Eastern gold demand has also fallen, despite surging oil revenues. The Saudi stock market crash is suggested as one reason. But China has picked up the baton, given a liberalisation of the gold market and newfound wealth has seen demand increase by 72%, albeit off a low base.

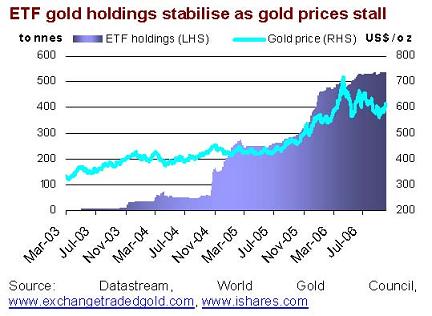

From 2005 and into early 2006, the greatest driver of the gold price was investor demand. Since the bubble burst, inflows into exchange traded funds have stabilised. GFMS notes holdings increased by only 19t in the September quarter, compared to 49t in June and 113t in March.

National anticipates falling interest rates in the US in 2007 (although other economists will question this, and Fed chairman Bernanke is still scaring the market over inflation) and suggest this will be a driver of renewed investor demand for gold, providing further upward impetus.

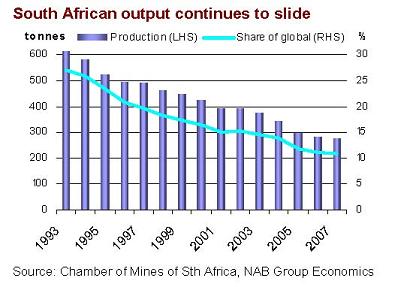

In the meantime, global gold production continues to decrease, despite higher prices. Underinvestment, as always, is blamed. Output fell 2.1% in the first three quarters, with South Africa, Australia and Indonesia producing less. Australia, and North and South America are expected to increase production in 2007, offsetting decreases elsewhere. South African production is still in decline, due to high costs and lower grades, but is likely to stabilise in coming years, says National.

Dehedging – a process whereby producers settle forward sale obligations – surged in 2006, largely as a result of the Placer Dome acquisition by Barrick, which resulted in Placer’s extensive hedge book being unwound. Dehedging removes production from spot markets, and as such places upward pressure on prices. While National expects dehedging to slow in 2007, the decline will be modest, and upward pressure should remain.

Central bank selling has diminished in the second year of the Central Bank Gold Agreement, where (officially) 395t were sold out of an allowed quota of 500t. While the Russians and Chinese are rumoured to potentially be buyers of gold, little has happened on that front yet, notes National.

At the end of the day, while debutant investor interest was a driving force in the gold price rally earlier in the year, such that macroeconomic factors were less of an influence, National is forecasting that US interest rates have peaked and a weaker economy will lead to falling rates in 2007. This is expected to become the driving factor for the gold price.