Commodities | Feb 07 2007

By Greg Peel

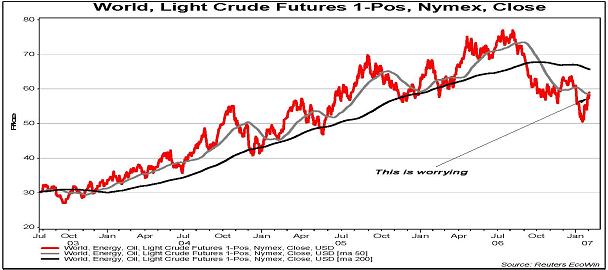

When last we spoke, free-thinking investment gurus GaveKal were bullish on global growth, but not on commodities. The analysts thought that one commodity in particular – crude oil – was stretched in valuation and deteriorating technically.

While global growth (ex-Japan) has been stronger than even GaveKal had forecast, with US data continuing to surprise on the upside, the analysts have been forced to concede that “two weeks in the markets is an eternity”.

Fundamentally, GaveKal was not expecting such a near-term price impact from the Bush Administration decision to double the strategic oil reserve. However, oil not only bottomed on the news but rallied 14% in the two weeks to Monday. Further impetus was provided by China’s announcement that it was not beyond increasing reserves either.

The technicals are now painting a different picture.

Says GaveKal: “We continue to hope that weaker oil will allow growth to boom and inflation to slow; but that’s no longer a sure bet”.