Commodities | Mar 28 2007

By Greg Peel

One great fear of gold investors has always been actual central bank gold sales which can have a dramatic and immediate effect on the gold price in the short term, irrespective of longer term views on inflation or the US dollar. But two trends have become apparent in 2007.

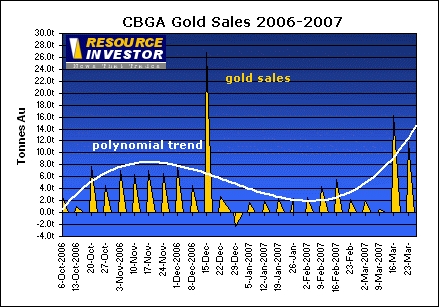

Firstly, central bank gold selling, particularly from the European banks which are signatories to the Central Bank Gold Agreement, continues to fall short of allowable quotas – a trend which began in 2006. Secondly, selling that has occurred has failed to undermine the overall strength of the gold market.

While gold is below its highs of earlier in the year, the culprit has been the “sell everything” attitude that started in February with the Shanghai Surprise/sub-prime/carry trade correction we had to have. While a wall of what might be considered “unofficial” official selling was slammed into around US$690/oz, traders have not been able to point their fingers at aggressive central bank selling as the reason gold traded back below US$640/oz. (Cynics claim, however, that there was plenty of paper selling going on from the “big boys”).

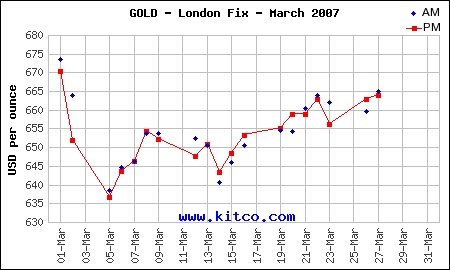

The dust has settled, and gold has grafted its way back up to US$664/oz. But notably it has achieved this over the last two weeks despite notification of real central bank selling.

ResourceInvestor.com reports that two CBGA banks sold a total of 12 tonnes of metal in the week ending 23 March. This follows 16 tonnes of sales the previous week. Last week’s sales probably go a long way to explaining the sudden price drop on Friday, but if you compare prices across the two week period, gold has risen from US$647/oz to US$664/oz.

ResourceInvestor calculates CBGA gold sales now total about 140 tonnes for the 2006-07 CBGA year which ends in September. Even though the pace of sales has quickened recently, signatories would still have to sell 60 tonnes per month to hit the allowable quota of 500 tonnes. Monthly sales currently average 23 tonnes, notes ResourceInvestor, which would put sales under 300 tonnes for the CBGA year.

Observers suggest that even if the pace of sales accelerated, the total is unlikely to exceed 400 tonnes given Germany’s indication that it has no plans to sell gold in coming years.

This is one element of the gold market that is keeping the bulls excited. Another element has gone largely unnoticed. John Embry, chief investment strategist at Canada’s Sprott Asset Management, points out that when gold hit a monthly closing high of US$669.35/oz in February, that was actually the highest monthly close ever recorded.

That can’t be right, you say. Gold hit US$725/oz in May last year and US$800/oz in January, 1980.

Ah yes, but in both cases gold closed those months below the February 2006 figure. The 1980 spike to US$800/oz was actually a two-day phenomenon, and spot collapsed to close at US$653 by the end of the month. May last year finished at US$660/oz. The previous monthly closing high was in September, 1980, at US$666.75/oz, Embry points out. Technically, this fact is significant.

Embry is convinced that gold will never see numbers below US$600/oz again. Central banks are running out of gold to sell – it’s as simple as that.

The alternative has been for central banks to sell gold on “paper”, through loan and swap arrangements which ultimately settle for cash. However, the International Monetary Fund – ultimate regulator and recorder of central bank gold transactions – is moving to update its regulations with respect to such “paper” deals, such that more disclosure will be necessary. If these regulations come into force, “actual” central bank gold positions will become more transparent.

There is no guarantee, however, that all changes will be passed.