Commodities | Apr 13 2007

By Rudi Filapek-Vandyck

A general consensus seems to be forming in the market that copper is due for a serious price pull back. The question of how serious this pullback will turn out remains open to public debate.

Among the negatives cited are the fact that nobody seems to believe the current labour conflict at major producer Codelco will actually result in a strike and renewed speculation Chinese buyers are keeping their hands on their wallets in the light of the recent spike in the spot copper price.

Several media have quoted a trading manager at the copper division of China Minmetals Nonferrous Metals, a unit of China’s largest metals trading company, as saying China’s refined copper imports could well drop by 50% in the current second quarter compared to the level of the first quarter this year.

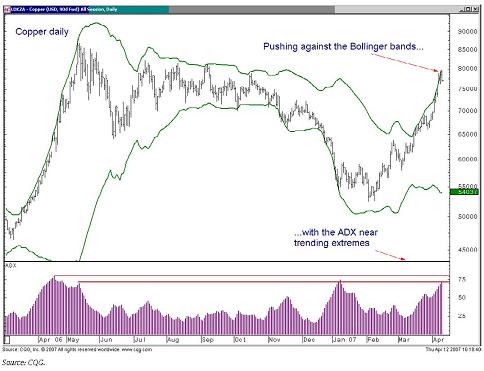

Technical chartists have started to point out that copper’s April rally seems to suffer from declining momentum as well. Technical chartists at Barclays Capital joined the latter group overnight.

While the chartists maintain copper is likely to ultimately exceed its 2006 peak near US$8800/t, the short term looks quite different. Last night the metal posted its first bearish candle following nine consecutive bullish days, the chartists reported this morning.

In addition, the gap formed at the start of the week is now looking increasingly like a sign of exhaustion, rather than a mid-point gap, they add. With the ADX (measure of trend) at historic extremes and the copper price testing its Bollinger Band, the chartists’ conclusion is the current rally is now looking “exceedingly overstretched”.