Commodities | Apr 18 2007

By Greg Peel

Enthusiastic precious metal investor James Turk notes that gold, silver and the US dollar made significant break-outs last week in their relevant directions.The Dollar Index ended the week at 82.13, noticeably breaking below 82.45 and therefore making a new 2-year low. The Index is now pointed toward its all-time low of 80.53 which is only 160 ticks away, or less than 2%. Says Turk:

“It won’t be long I expect before that low is broken too, after which the dollar will collapse. Are you ready? The best way to get ready is to be out of dollars, and own the precious metals instead.”

As the dollar was falling, both gold and silver became poised to break out to multi-decade highs – at least that is Turk’s technical interpretation.

That the US dollar is weak and getting weaker, and given that global gold production is trending downwards against growing demand, is why there is a widely-held belief that the price of gold is going higher. More radical views have the US dollar undergoing a spectacular collapse while central banks run out of physical gold needed to be sold to support the currency. In the latter case – name your gold price. Numbers of US$1000/oz or US$2000/oz have been mentioned.

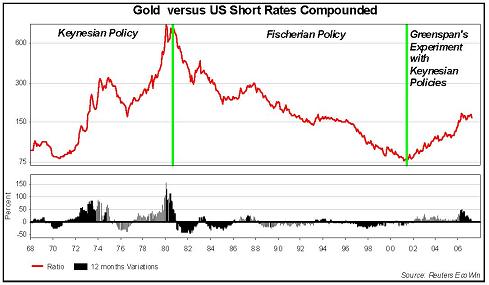

Investment consultants GaveKal tend not to look at things the same way everybody else does. They are not convinced as to the value of gold, indeed referring to it as “the barbarous relic”. Movements in the gold price over the last three decades are readily explained by differing monetary policies, according to GaveKal’s analysis.

In the 1960s and 70s global monetary policies were dominated by Keynesian economics which suggested the Great Depression was caused by an excess of savings. To avoid such an excess, central banks maintained short term interest rates below the growth rate of the GDP, systematically undermining the value of savings. This policy then led to the high inflation of the 1970s.

When no one was willing to save anymore, monetary policy switched to a Fisherian model in which the real rate of interest is deemed to be constant such that the nominal rate moves with inflation. Again this worked well until the turn of the new millennium after the velocity of money collapsed and Japan was forced into depression. In 2002, Fed chairman Alan Greenspan returned once more to a Keynesian model.

The Keynesian model involves a debasement of the currency leading to a weaker currency under easy liquidity and low interest rates. When the US dollar is debased, the US dollar gold price tends to rise. Under a Fisherian model it is better to own cash than gold.

The graph below represents the gold price deflated by compounded US short rates (based at 100 in 1972).

Ben Bernanke took over as Fed chairman twelve months ago and has been bringing short rates back to a more “normal”, Fisherian level. If the past is any guide, notes GaveKal, then the gold price should be looking to peak once more.

However, it hasn’t so far. When the Gold Standard was dropped in the early 70s the world moved to the US dollar as the benchmark currency and the “standard” was driven by the fledgling futures market in US Treasury bonds. Thus the world’s currencies have been driven since not by central bank gold inventories but by bond markets. The current rise in the gold price is thus not due to a concern of coming inflation, GaveKal suggests, as it is rising in the face of an inverted yield curve. An inverted yield curve signals falling inflation. GaveKal notes that its indicators are not signalling inflation in the OECD system.

“In the past twenty years”, says GaveKal, “investors have been offered an ever growing array of financial tools against which to hedge the risk of government manipulation”. In other words, the old-fashioned asset that is gold is no longer a necessary tool to be used to hedge against changes in monetary policy. However (and this is a big however), the same array of tools has not been on offer to emerging economies.

The inflation rate in India is currently around 6.5% and real rates are negative. In the meantime, the Indian government has been dumping rupees into the system to prevent the currency from rising. The average middle-class Indian can invest in the stock market or in property, both of which have been soaring, but what can he do to diversify his risk? He can’t hold cash or bonds while real rates are negative. The solution is to put money into gold. And that is hardly a leap of logic given the Indians’ cultural preference for gold.

The same can be said of China.

Therein lies the answer to gold’s ongoing price rise, GaveKal concludes. It is directly correlated to the booming economies of India and China. Hence if these economies were to peak, there should be a resultant peak in gold investment.

It is notable that there was a significant drop in the price of gold following the “Shanghai Surprise” of February when the Chinese stock market briefly tanked. However, by most accounts there is very little presently standing in the way of the ongoing growth surge of these emerging economies. Does that mean the gold price must continue to go higher?

It may go higher, but only until, as GaveKal suggests, Indian and Chinese individuals are allowed to diversify away from domestic assets. In the case of China, movements have already been made in that direction. When this happens, says GaveKal, the demand for gold will collapse, and a new supply will be “dug out of the back yard” by investors looking to diversify into US equities, European bonds…whatever. Says GaveKal:

“The lifting of exchange controls in India or China is a Damocles sword hanging over gold’s head.”