Commodities | May 07 2007

By Rudi Filapek-Vandyck

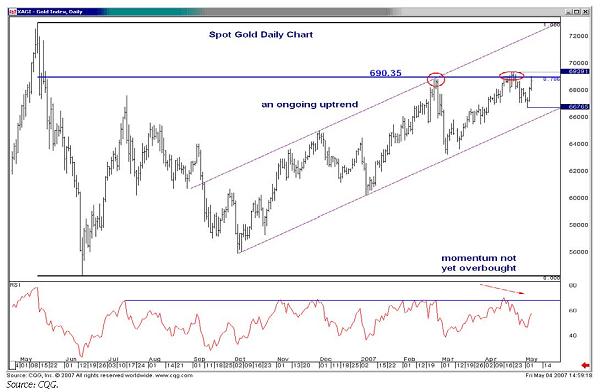

Over the past few months gold bullion has repeatedly tried to break through key resistance at US$692/oz, but each attempt led to renewed failure and subsequent temporarily lower price levels.

This time, however, the odds seem in favour of the precious metal finally breaking through the pivotal price level and push to US$700/oz and beyond, market watchers say.

The fact that the US dollar last week managed to bounce back but seems to have run out of puff already only further strengthens the overall positive mood regarding gold’s near term price potential.

US based trading guru Dennis Gartman, for one, has thrown all inhibitions overboard, reporting to his clientele on Friday: “it appears to us that the long awaited assault upon [US]$700 lies just ahead”.

The view finds support among technical chartists at Barclays Capital who believe that as daily momentum has not yet reached levels consistent with previous highs, but gold is already back beyond US$685/oz, while taking into account the ongoing pattern of higher highs and higher lows; this time could be it!

Barclays Capital believes that if gold bullion manages to break through technical resistance between US$690.35/693.77/oz (previous highs, 78.6% retracement of the May/June 2006 decline) this should set the market in motion for further gains to US$700/oz and beyond.

This view would be distorted if the metal would fall back below US$667.65/oz, the May-02 low, the chartists warn.

Barclays Capital remains of the view that gold’s choppy range will eventually give way to the topside and once the metal has moved above US$695/oz it should target US$730/oz and ultimately US$850/oz.