Commodities | Aug 10 2007

By Chris Shaw

With the market trading shoulder season dates Commonwealth Bank had expected a fall in oil prices as this coincides with the seasonal slow period of the northern hemisphere summer, before demand and therefore prices pick up again ahead of the northern winter.

What has surprised the bank and commodity strategist Tobin Gorey is the speed of the fall, as prices have dropped sharply from levels relatively close to US$80 per barrel to below US$72.00 per barrel for West Texas Intermediate (WTI).

In hindsight the fall is not surprising, as Gorey notes recent OPEC comments indicating prices around US$80 were enough to justify additional supply coming onto the market gave traders little incentive to hold onto long positions.

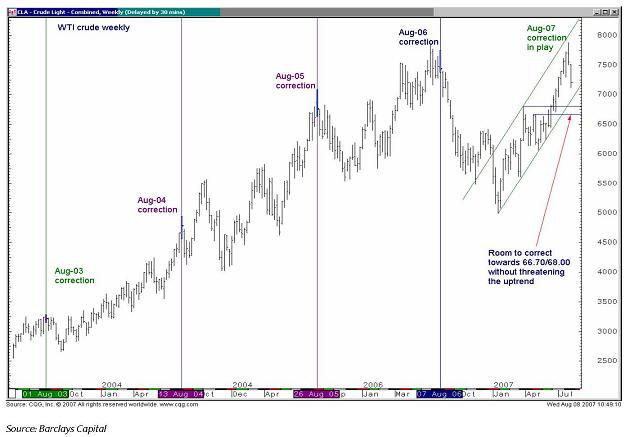

Additionally, technical chartists at Barclays Capital note the last few years have shown a trend for the oil price to fall through August, so in this respect the price action in the first part of the month suggests this year will be no different.

Accepting then this seasonal decline is underway, how far could the price fall?

In Gorey’s view possibly not much further, as he sees it as likely much of the selling pressure has come from traders getting out of long positions in the oil futures market. If this is the case, and official open interest positions should be known by Monday, he suggests the price is likely to bottom around the low US$70 per barrel level, which is about where it is now.

Looking at it from a technical perspective Barclays chartists see scope for the decline to extend further and continue into next week at least, with some chance price could fall as far as US$66.70/$68.00 as this is an area of previous resistance and should now act as strong support. (An intermediate bounce is seen as likely).

Even allowing for such a fall the uptrend would remain in place in the group’s view, though any attempt to push the oil price higher is likely to be met by resistance at the current 121-day moving average level of US$74.88.