Feature Stories | Mar 24 2009

(This story was originally published on March 17, 2009. It has now been re-published to make it available to non-paying members at FNArena and readers elsewhere)

By Greg Peel

“I’m so happy, ’cause today I found my friends – they’re in my head” (Kurt Cobain)

“Little Betty bakes cakes never on Friday nights” (High school chemistry mnemonic)

Those of you who, like I, were required to memorise at least the early elements of the periodic table in high school would recognise the above mnemonic as translating to Li, Be, B, C, N, O, Fl, Ne which, after hydrogen and helium, form the first complete line of the aforementioned table. With an atomic number of 3 (protons), lithium in theory was the third element to be created after the Big Bang, and while its predecessors of hydrogen and helium are gases, lithium is the first, and lightest, metal.

Given lithium has a tendency to explode at room temperature, it is never found as a pure element, but rather it exists mostly as lithium oxide or “lithia”, the most common of which is the charmingly named “spodumene”, or in brine, the most lithium-rich sources of which are found in valleys of the Andes and Himalayas. But the metal’s reactive nature is that which makes it a very suitable element for the development of batteries.

It has only been in recent times, however, that lithium ion batteries have hit the scene. Early attempts resulted in batteries that would suddenly discharge and dangerously overheat if short-circuited, but technology has now overcome such problems. Before lithium was used in batteries it was popularly used as an anti-depressant. It is still used as such today, and was notably used by tortured Nirvana front man Kurt Cobain, the opening lines of whose ode to lithium appear above.

Not without a dash of irony, lithium was particularly popular during the Great Depression. Not that everyone taking lithium would have necessarily known about it, given it was sold as a popular soft drink claiming to be a hangover cure. Lithium’s atomic weight is 7, and it is an “upper”, and hence the soft drink was called 7-Up. At least, that’s the no doubt apocryphal tale. If you’re a lemonade fancier don’t panic – the lithium was removed from production in the 1950s. It is interesting to note, nevertheless, that 7-Up hit the stores in 1929 – the same year a rival soft drink saw the removal of all traces of cocaine.

As we enter what many are now referring to as the Great Recession, we might like to think the lithium could be put back into lemonade, but the fact is that lithium is rapidly becoming a globally important element given the increasing use of the lithium ion battery.

The number of hand-held devices powered by rechargeable batteries is growing exponentially, from the cordless drill to the iPhone. The first rechargeable batteries were the lead-acid variety used in cars, before nickel-cadmium came to the fore for much smaller devices. While nickel-cadmium still competes with lithium ion today, one big disadvantage of the former is that the batteries have to be completely drained before recharging if one is to get any life out of them. Readers may remember early models of mobile phone which had to be run until the inevitable cut-off mid conversation. Nowadays mobile phones can be plugged into the recharger at any time without damage, because they use lithium ion batteries.

Thus if one were to make a case for increasing global lithium demand, one might need go no further than your iPhone, digital camera, Blackberry etc and the amount of young Chinese, Indians, Russians and Brazilians who covet them. However, while this case indeed has merit, it potentially pales into insignificance when one considers that lithium batteries are ideal for electric cars.

It has taken many decades, but constant and successful efforts by Detroit to quash the development of the electric car have finally come back to bite the Big Three on the backside. Any child could be taught the dangers of arrogance through the example of General Motors buying the Hummer brand in 1999 - two years after Toyota launched the Prius and subsequently changed the world. The GM Hummer is a four tonne urban tank powered by a small six cylinder engine which achieves one mile to the gallon petrol consumption at cruising speed. While doubts have been raised about the true engine efficiency of the Prius, it is nevertheless a petrol-electric hybrid that can achieve 66 miles to the gallon.

The Prius can be considered the prototype for the commuter car of the future. Automakers across the globe are now falling about themselves to design not only the next generation of petrol-electric hybrids, but also the first truly practical fully electric cars. The hybrid was a leap forward in electric car capability as it does not require external recharging. Instead, the petrol engine provides recharging capacity. And if you’re stuck in the middle of nowhere without battery power, the hybrid simply becomes a petrol car. The next step along the evolutionary path is the “plug-in” hybrid.

The plug-in hybrid still exploits a petrol engine but the capacity to recharge the family car from the household mains further reduces the amount of fossil fuel needed for day to day running. The obvious next step is to do away with the petrol engine altogether and simply go all-electric. You just plug in overnight.

The need for a fully electric yet practical car has clearly become an urgent one ever since the oil price hit US$147/bbl and the world began to panic about its carbon footprint. The fact that oil is now back at US$45/bbl is not fooling anyone. We will not be in the Great Recession forever and Chinese vehicle sales showed 24% year-on-year growth only last month. The fact that China is only now embracing the car is ominous for global warming in the future and one reason why Western industry is lobbying so hard against carbon trading when no such restrictions exist in developing nations. However, China does not need to follow the same evolutionary path of industrial revolution as the West – it need only jump in at the current point on the technology time curve.

For example, Westerners are increasingly abandoning costly land line phones and becoming mobile-only households now that competition has brought the cost of mobile calls down significantly. The Chinese are now rapidly embracing the telephone at the Middle Class level but mostly doing so by going straight to the mobile phone option. Nor does China need to spend decades falling in love with the gas-guzzler. Once hybrid and electric cars are commercially viable the Chinese will simply choose such as a first car. And without the same legacy of huge numbers of used cars on the road a decade or more old, China’s ultimate transport carbon footprint could put the West to shame.

One could be forgiven for arguing that if we all have electric cars other than petrol/diesel ones, then we will only be increasing the amount of power we draw from coal-burning power stations and thus negate any carbon footprint reduction. The reality is that the average car achieves 30 miles to the gallon of petrol. Equating petrol to coal-burning, an electric car would achieve 100 miles to the gallon equivalent. A major net reduction in emissions would occur if everyone in the world drove electric vehicles.

The next problem is to make electric cars commercially viable, and therein lies a bit of a chicken and egg problem. If one wants to drive a distance from one’s house or place of work, one would need to recharge elsewhere. There are still a lot of petrol stations about, but not a lot of electric stations. And recharging takes several hours. Until the electric car is ultimately practical, it will not win mass appeal, and therefore the economies of scale won’t be created to bring the price of electric vehicles down to beyond rock star self-promotion level. This is where lithium ion batteries step in.

One of the first fully electric cars to be developed commercially beyond the prototype stage is the Tesla roadster. The Tesla’s technology advancement is such that it can accelerate from zero to 60mph in 3.9 seconds, hit 125mph and travel for 244 miles before recharging is required. Range is achieved through “regenerative braking”, which means the kinetic energy created through the friction of braking is rechanelled into recharging the batteries. The Tesla costs about one US cent per mile to run. It uses lithium ion batteries, which offer higher power output than other batteries and thus they are cheaper in an application where many are used. While new materials used in battery manufacture have reduced the weight of such batteries, an electric car still needs quite a few of them. The offset comes from the electric motor which, compared to a petrol motor, is tiny.

Even the Top Gear petrolheads were impressed with the Tesla, which is manufactured by Lotus, once owned by GM, now owned by Proton. Unfortunately we’re still in the realm of only rock stars and Hollywood actors making the symbolic change to electric nevertheless – the Tesla retails for over US$100,000.

But it is a step in the right direction. And the other promising element of the electric car is that one can simply replace one or more lithium ion batteries as they fade rather than recharging them, which opens up the possibility of a “Swap’n’Go” style supply at every service station, right next to the barbeque gas tanks. Petrol stations do not need to be expensively converted to electric stations at all.

It should not be long before an electric commuter car can be economically owned by your average household. The petrol bowser could realistically go the way of the video in a very short space of time.

One might also use the flat-screen television and the old cathode ray tube boxes as another analogy. However, the ultimate world domination of the flat screen TV involves one small hurdle. Flat-screen TVs, as well as the latest mobile phone screens, rely on a combinations of “rare metals” such as iridium and ruthenium. These metals are not called “rare” for no reason. It is argued global supplies of such exotica are tenuous.

While lithium ranks behind only hydrogen and helium on the periodic table, it is not necessarily equivalently abundant. Were estimated global supplies of lithium to be considered tenuous, then it would be foolish for the world to rush in and embrace the lithium ion battery as a revolutionary saviour.

In its extensive investigation of the lithium market, stockbroker State One has made note of a research article published last year which questioned the ongoing supply of lithium and made comparisons to “peak oil” claims. However another article written two months ago, which draws upon data published by two major global lithium companies, disputes this claim and suggests there is enough supply to cover projected world demand (electric cars included) for the next 100 years.

Any question of supply is thus not considered to be one of global reserves but a lack of investment to date in global lithium mining projects.

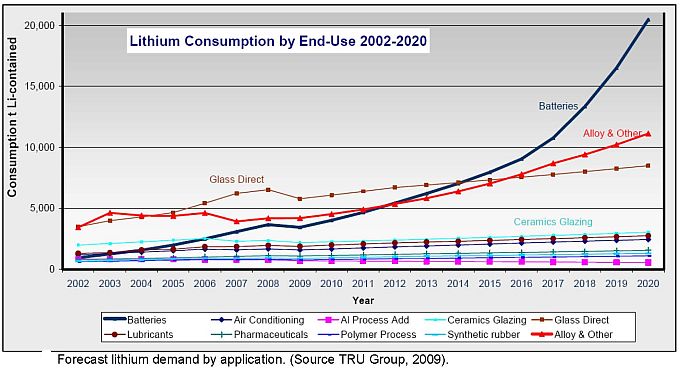

As the following chart shows, global demand for lithium for use in batteries is expected to grow exponentially. Total global demand in 2007 was estimated at 93,000 tonnes continuing a trend of more than 5% compound annual growth. Unprecedented demand growth has been occurring since 2004, over which time demand for lithium in battery use has grown by more than 20% (compound annual). State One notes: “While current latent capacity and forecast additional supply from developing projects is projected to meet increased lithium demand in the medium term, the capacity for supply to keep up with demand is finely balanced. Should projects suffer financing, logistical or regulatory hurdles, a supply squeeze is likely to be brought forward which will result in upward pressure on lithium prices”.

At the current rate of growth of both demand and supply, forecasters suggest a supply squeeze will occur around 2018. However, Japanese and other Asian battery manufacturers have already publicly stated concerns regarding security of supply, notes State One, and should China or others stock pile product, or should the take-up of electric cars exceed expectations, the balance will be tilted towards a supply squeeze occurring sooner.

The world’s largest source of mineral lithium production is the Greenbushes mine in Western Australia owned by Talison Minerals (unlisted) which last year produced 70% of global mineral lithium supply. Lithium production from brine is a highly consolidated industry with only four significant producers operating in Chile, Argentina, the USA and China. Chile leads the world in lithium production, and in 2007 Chile’s Sociedad Quimica y Minera (SQM) produced a third of total global supply of lithium carbonate equivalent. Lithium concentrate is converted into lithium carbonate prior to industrial use.

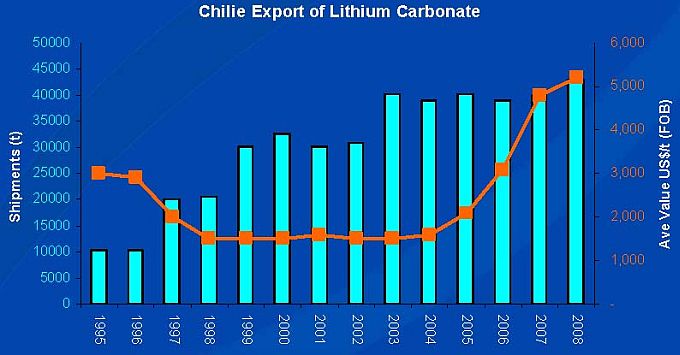

Lithium carbonate is traded across the globe as a bulk mineral in a similar fashion to iron ore. Thus unlike base metals such as copper, lithium is not exchange-traded and has no futures contract. Transactions are contract-based as “off-take agreements” meaning there is not a lot of transparency of global pricing. The following chart shows that Chilean lithium carbonate sold at an average price last year of US$5,000/t.

Source: Galaxy Resources

The other point of note about this price chart is that from 2004 the price of lithium has done nothing but go up. Indeed, 2009 prices are expected to be higher again. How many industrial commodities can claim price rises in 2008 and 2009?

Enter Galaxy Resources. Galaxy Resources ((GXY)) is on track to produce a lithium carbonate product that would sell currently for US$6,500/t, according to State One. Notes State One analyst Sam Berridge:

“While there are a number of emerging lithium projects that have been born of the forecast spike in demand, Galaxy Resources is in an envious position as having the most advanced project in the western world. The project has been found to be financially robust and is awaiting final contract and financing arrangement prior to commencing construction.”

State One is a 12% shareholder in Galaxy Resources.

Galaxy owns the Mt Cattlin lithium-tantalum project which lies near the town of Ravensthorpe in south-western Western Australia. Ravensthorpe is also the location of BHP Billiton’s giant nickel project which, given the current price of nickel, is currently on hold. Hence there is no lack of workforce about. Ravensthorpe is also close to the port of Esperance. The project is located on existing farmland and the process of lithium extraction causes minimal environmental impact.

The Mt Cattlin mineral resource is very similar to that of the Greenbushes mine in the same vicinity. However, while Greenbushes has now reached significant depth in its ongoing open cut operation, the resource at Mt Cattlin is wide, shallow and easily accessible. Galaxy expects to produce one million tonnes per annum of mineral lithium over a 15 year mine life on current reserve estimates.

Galaxy’s managing director Iggy Tan boasts 22 years of experience in mining and chemicals including management of the Greenbushes project in 1995 for then owner Sons of Gwalia. FNArena was invited to attend a presentation by Mr Tan last week.

Galaxy has completed a definitive feasibility study (DFS) into the Mt Cattlin project and has now commenced the process of establishing off-take partners, commercial, project and corporate debt-raising and structuring. The words “debt-raising” in relation to a start-up mining project may spark fear into potential small investors in 2009, but while Mr Tan was not at liberty to divulge as yet unreleased information, he was happy to suggest that interest from Japan, Korea and China has been more than promising.

The DFS concluded that the net present value of the project in current form is A$128m, which after capital raising equates to A$1.20 per share. Galaxy shares currently trade at around 35c. However the DFS valuation does not include conversion of lithium concentrate into lithium carbonate. It does suggest significant valuation upside once a toll treatment agreement on conversion is reached with processing facilities in China.

While outsourced toll treatment is the initial option, Galaxy’s advanced plan is to build its own facility on site. State One suggests the initial strategy reduces the financial and technical risk of the Mt Cattlin project and allows the lithium concentrate circuit to be optimised and cashflow generated prior to adding value via Galaxy’s own lithium carbonate facility. Now that as the costs associated with building any mining industry facility have greatly reduced, the time is right to pursue such a project.

Incidentally, lithium carbonate takes the form of totally inert and dustless pebbles, which should delight the townsfolk of Ravensthorpe and Esperance.

Aside from the potential upside value in toll treatment and its own toll treatment plant, Galaxy can also “easily” upgrade its mineral reserves, according to Mr Tan. Galaxy owns an option to purchase all of the land on which the orebody sits and is expects to exercise the option in late 2009 upon the commencement of the initial lithium concentrate facility. Nor is the reserve upside considered in the DFS net present value calculation.

Galaxy expects an internal rate of return on the Mt Cattlin project of 34% (assuming an Aussie at US$0.65) with pay-back on development within four years.

So keen on the future growth of the electric car and subsequent lithium demand was billionaire investor Warren Buffet that he last year invested US$230m in a stake of Chinese lithium producer BYD. As part of its auto-industry rescue plan, the Obama administration has targeted one million plug-in electric vehicles on the road by 2015.

Pass me the 7-Up.