Australia | Jan 18 2010

By Rudi Filapek-Vandyck

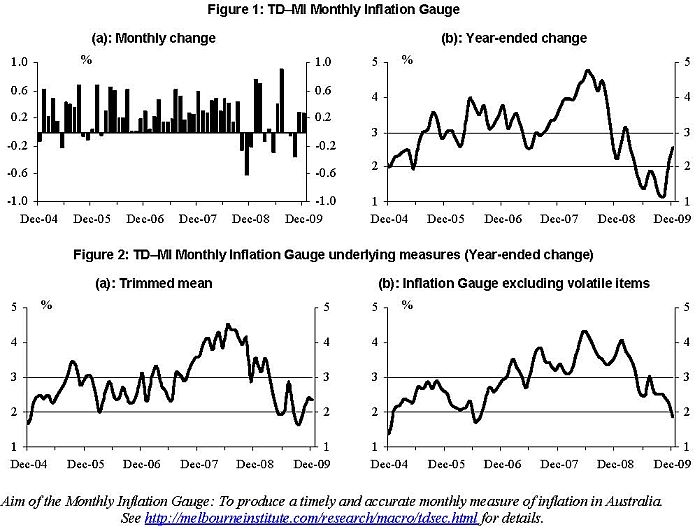

The TD Securities-Melbourne Institute Monthly Inflation Gauge rose by 0.3% in December, following a 0.3% rise in November and a 0.3% fall in October. In the twelve months to December, the Inflation Gauge has now risen by 2.6%, firmly in the mid-point of the RBA’s 2 to 3% target band.

Contributing most to the overall change in December were seasonal price rises for holiday, travel and accommodation, fruit and vegetables, and automotive fuel. The economists report these price increases were offset by falls in prices for rental accommodation, financial services, and books, newspapers, and magazines.

The trimmed mean of the Inflation Gauge rose by 0.1% in December, following a rise of 0.2% in November. In the twelve months to December, the trimmed mean has now risen by 2.4%, also around the mid-point of the RBA’s 2 to 3% target band.

Annette Beacher, Senior Strategist at TD Securities, suggests that after a period of clear disinflation over the year from mid-2008, inflation in Australia has now not only bottomed out, but early signals suggest some emerging upside pressure. Beacher comments this shift justifies the recent rapid-fire adjustment to the cash rate by the RBA from 3% to 3.75%.

Beacher also stresses 3.75% is still a very accommodative cash rate given the buoyant outlook for Australian growth.

TD Securities anticipates the RBA will raise by 25bp at its February meeting and then pause in March.

Co-creator of the inflation gauge, professor Don Harding comments that, based on the data to November, the official December quarter CPI is forecast to rise by about 0.1%, yielding an annual inflation rate of 1.7% in the four quarters to December 2009.

Harding highlights that overall price pressures in December remained subdued, with prices rising in 23 expenditure groups and falling in 19 for a net balance of 4 rises.