Commodities | Jan 21 2010

By Andrew Nelson

There are two raging debates when it comes to oil prices. The first centres on the effect speculation has on oil prices, while the second argues the causal link between oil prices and the US dollar. The question is: which one carries more weight?

When oil prices soared to an all-time high of US$147 back in the summer of 2008, which if you recall was right before the GFC hit the fan, many started to wonder whether the fundamentals of the market could change quickly enough to justify the rally.

The EUR/USD certainly didn’t weaken enough to explain soaring energy prices on its own. And while inventories declined sharply as prices spiked, this also wasn’t enough to explain the surge. So was speculation the prime factor?

Danske Bank senior analyst John Hydeskov thinks that at least from an economic point of view, causality in the dollar-oil relation could run both ways. On the one hand, because oil contracts (and most other commodities) are quoted in USD, a weaker US dollar should logically lead to increased prices in order to compensate non-US based market participants.

But on the other hand, a rising oil price has a tangible effect on real economies. While this effect is different for net exporters versus importers of oil, for importers it leads to rising inflation almost automatically. Thus central banks raise interest rates and this in turn leads to currency fluctuations.

Taking a look at the impact of speculation, Hydeskov points out that the official US Commodity Futures Trading Commission (CTFC) report on crude oil did not “detect any clear effect of non-commercial positioning” on oil prices. Translation: the CTFC couldn’t prove that speculation has a significant influence on oil prices. Yet the debate about the impact of speculators in commodity markets remains a hot political issue.

Just last week, the CFTC made a first proposal to introduce limits on the number of contracts individual traders can hold in a particular market. While the proposed rules were a little softer than expected, Hydeskov thinks that the last has not been heard of this issue given the political focus that remains. And realisticly, it is more than plausible that speculation could drive oil prices. This, not the fact that there is evidence, is what is fuelling the ongoing debate.

Although, it is easy to imagine that higher oil prices could see more speculators enter long positions and thus causality could run both ways.

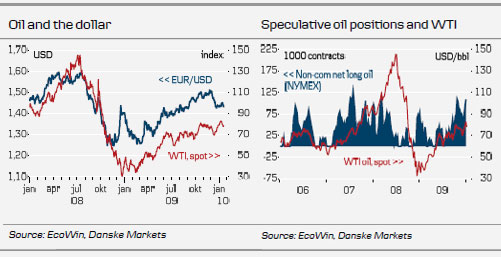

To this end, Danske has conducted an analysis on the correlations and the causal mechanisms that may lie behind them using a simple model based on weekly data with four lags for the WTI price, EUR/USD, US oil inventories, and non-commercial net long positions in oil at NYMEX. The bank has chosen to look at the data for insight into short-term co-movement, given over the longer-term additional factors like industrial production, which can’t be used on weekly basis, are likely to be of material importance to oil prices.

The finding: over the short-term, Hydeskov finds that the main drivers of oil are, aside from non-commercial positions, US stock changes and deviations from a long-run equilibrium relation, or error correction behaviour.

When looking at the most recent period of sample data between 2004-09, it seems that movements in WTI usually precede those in EUR/USD, which may indicate that a rise in oil prices leads to a weakening of the US dollar. This, says Hydeskov, supports the theory that the economic effects of rising oil prices outweigh any measurement effects from oil being quoted in USD.

Yet at the same time, Danske finds that non-commercial positions have, if anything, had a positive effect on oil prices on a weekly basis in recent years. But just like the CFTC report, Danske was unable to identify any sort of clear-cut effect that speculation might have. Thus, causality runs both ways according to Danske’s tests, while anecdotal evidence admittedly points to speculators playing an important role of late.

Lastly, Hydeskov points out that a rise in US oil stocks has a negative effect on oil prices, but this is something we all knew already. There always seems to be some sort of market reaction following the release of the weekly US oil inventories, especially when a surprise reading is released.

All up, Danske believes any effect speculation may have only added up to a short-term phenomenon, as over the long-term, notes Hydeskov, there is no clear evidence that non-commercial positions drive oil prices higher. Yet the longer-term view does suggest that the WTI correlates closely with EUR/USD.

However, with all of that said, Hydeskov notes that your normal, run of the mill supply and demand factors, which are not assessed in Danske’s recent study, tend to be of major importance in determining where oil prices are heading.

Summing it all up: speculation might have a tangible effect on oil, the USD/EUR probably does, while supply and demand unequivocally do.