Commodities | Jan 25 2010

By Rudi Filapek-Vandyck

It is a sentence that is heard more and more often these days: have investors overestimated actual demand for commodities?

Sector analysts at Barclays Capital remain confident this will prove not to be the case, for most resources. However, when it comes to natural gas they believe the answer is a firm yes.

Natural gas prices in the US have been able to withstand the fall in prices for crude oil and Barclays analysts believe this is due to investors hoping that a cold winter will assist in working through the remaining surplus inventory that continues to hang over the market (has been there for 18 months now).

Overall bullish sentiment is further fuelled by expectations that a steep drop in US supply (as a result of a lower rig count) will assist in tightening the market on the back of growing demand (the latter as a result of the recovering economy).

All nice and logical, in theory, but reality is different, suggest the analysts. They believe US producers have slashed drilling, but they have not cut supply by enough. Barclays expect US natural gas production, which has to date only slipped 1.4% from its peak in February 2009, to continue to fall through the first six months of calendar 2010, and to grow modestly at the end of 2010.

But, highlight the analysts, the performance of US output highlights an inescapable conclusion: producers were able to significantly boost rig productivity during the drilling downturn of 2009, with most independent producers growing sequential, company-level production even with large drilling cuts.

To make matters worse: exacerbating the less-than-expected slide in US production should be growth in LNG imports, at 1.9 Bcf/d over 2009 levels, almost completely offsetting the US production decline.

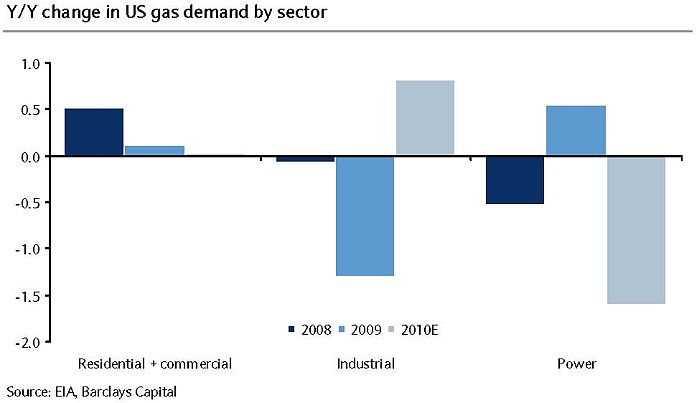

Finally, US demand is expected to fall for a second straight year in 2010. As far as the demand side goes, it has all to do with US utilities which are no longer replacing coal with gas as aggressively as they did in 2009.

Concludes Barclays: the resultant drop in power sector demand for gas overwhelms gains in residential, commercial and industrial consumption, even when factoring in a cold start to January 2010.

If Barclays view proves correct, the US market should see incrementally more supply hitting the market as calendar 2010 progresses. The result is that the market in 2010 is likely to end up “moderately oversupplied”.

In terms of price forecasts, Barclays expects Henry Hub prompt-month prices to average US$5.25MMBtu this year. This is lower than what NYSE futures are currently trading at (US$5.82).