Australia | Jan 27 2010

By Andrew Nelson

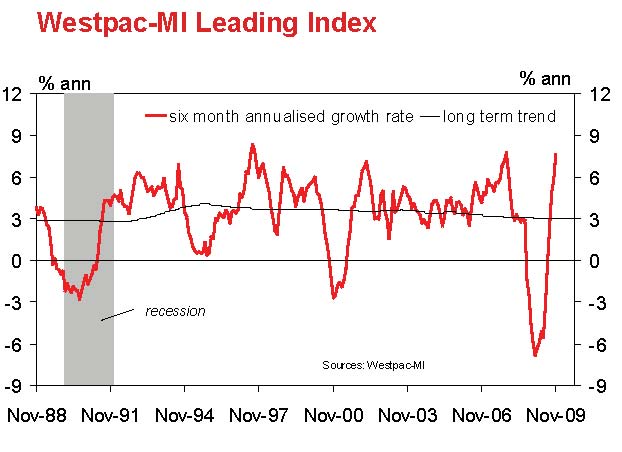

If anything, the pace of Australia’s economic recovery seems to be picking up pace, that is if the steady growth rate of the Westpac-MI Leading Index is anything to go by. Over the last six months, Australian growth has accelerated from 3.2% in June to a November level of 7.6%, making it the fastest turnaround in the Leading Index growth rate since the economy came out of recession in the mid 1970’s.

As far as Westpac Chief Economist Bill Evans is concerned, this sharp recovery in the growth rate is pretty much in line with the bank’s overall view of the economic outlook, which is unsurprisingly positive. In fact, Westpac expects the growth rate of domestic demand to bounce back from around 1.25% in 2009 to 4.25% in 2010, which Evans notes is being driven by much stronger momentum in consumer spending, dwelling construction and business investment.

However, he thinks the recovery in GDP growth will be more moderate, rising from 2% in 2009 to 3.5% in 2010. Evans explains that the difference between domestic demand and GDP is best explained by inventories and net exports.

In 2009, Westpac expects that inventories added around 1.25 ppt’s to GDP growth, with companies restocking through the course of the year after what was a “huge” initial collapse in demand when the GFC hit the fan. The bank thinks that inventories will be fairly stable in 2010, thus adding very little to GDP growth. Similarly, Evans expects net exports will also only add around 1 ppt less to GDP growth in 2010 than in 2009. So despite a much stronger export performance in 2010, he believes the 2010 recovery in import growth will probably more than offset the export effect.

So with the Reserve Bank Board next meeting on February 2, the latest evidence from the Leading Index, coupled with the Westpac Melbourne Institute Index of Consumer Sentiment, the labour market and recent trends in retail sales all suggest the central bank will be very likely to ratchet monetary settings back to a level where interest rates no longer act as a stimulus on the economy.

In fact, notes Evans, a recent speech from an RBA official hinted that such a level for the overnight cash rate might be somewhere around 4.5%, which is a few 25bp moves from the current 3.75%. It should be unsurprising then that Evans expects to see another rate hike of 0.25% to be announced by the Reserve Bank next week, with a pretty good chance of another two increases of 0.25% by June.