Commodities | Apr 17 2008

By Rudi Filapek-Vandyck

Long term prospects and short term supply-demand characteristics in the uranium market continue to clash with market watchers and researchers clinging on to a continuously bullish outlook for the commodity, only to see the spot price move into the opposite direction.

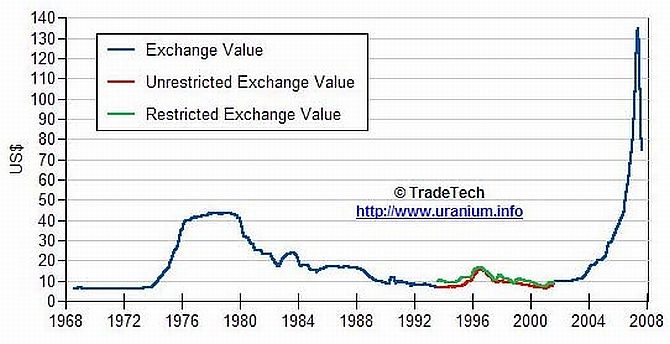

Industry consultant Ux Consulting decided to slice off US$3 from its weekly spot price indicator, hot on the heels of a similar move by peer TradeTech who earlier lowered its own weekly price indicator by US$2 to US$69/lb. UxC’s spot price is now US$1 below TradeTech’s, which may indicate the trend is still for lower prices.

The longer term price indicator has remained unchanged at both consultancies, at US$95/lb. Also, both consultants have now effectively cut their prices by 50% from last year’s peak. TradeTech’s spot price has fallen from US$138 to US$69/lb and UxC’s from US$136 to US$68/lb.