PR NewsWire | Nov 01 2021

$13.6M RAISING STRONGLY SUPPORTED

PROCEEDS TO FAST-TRACK LITHIUM EXPLORATION IN CY2022

Key Highlights:

- Heavily overbid $13.6 million placement to fast-track exploration activities at the Marble Bar Lithium Project (MBLP).

- As part of the placement, the lithium chemical arm of Contemporary Amperex Technology Co. Limited (CATL) (the world’s largest EV battery producer), Yibin Tianyi, to invest $6.2 million for a 9.9% interest in Global Lithium.

- Placement funds will be directed towards accelerating activities, including:

– Further lithium resource extension, targeting and regional exploration drilling;

– Initial exploration drilling along the southern extension of the greenstone belt, where historical drilling has identified lithium mineralisation 15km from the Archer deposit;

– Further exploration at the Company’s under-explored gold prospects, including the emerging Twin Veins project;

– Completion of the preliminary metallurgical test work program; and

– Potential consideration of additional complimentary growth options. - Global Lithium has a large tenement package to explore. Subject to targeting work, the Company anticipates a large amount of the activity in CY2022 will be directed towards exploration extending beyond the Archer deposit and following the greenstone towards the south, particularly into the newly acquired southern tenement package where lithium mineralisation has been identified in historical drilling.

PERTH, Australia, Nov. 1, 2021 /PRNewswire/ – Pilbara-focused lithium explorer, Global Lithium Resources Limited (ASX: GL1, Global Lithium or the Company) is pleased to announce it has received firm commitments for a $13.6 million capital raising (Capital Raising) to underpin an accelerated exploration program at the Company’s wholly owned MBLP.

The Capital Raising, which was heavily overbid, includes the introduction of highly regarded lithium hydroxide producer, Yibin Tianyi Lithium Industry Co Ltd (Yibin Tianyi) as a cornerstone shareholder of Global Lithium, committing to invest $6.2 million for a 9.9% interest (post completion of the Capital Raising).

The Capital Raising was conducted at an issue price of $0.37 per ordinary fully paid share (New Share) and comprises:

- A $7.3 million placement via the issue of 19,771,250 New Shares to institutional and sophisticated investors to be issued under the Company’s existing placement capacity in accordance with ASX Listing Rule 7.1. Allotment of these New Shares is anticipated to occur on Monday, 8 November 2021;

- A $6.2 million placement via the issue of 16,699,794 New Shares to Yibin Tianyi (or its nominee), subject only to the approval of shareholders at a general meeting to be convened in December 2021; and

- A $0.15 million placement via the issue of 405,405 New Shares to certain Directors of Global Lithium, subject to the approval of shareholders at the same general meeting.

Argonaut and Euroz Hartleys acted as Joint Lead Managers for the Capital Raising.

Global Lithium Managing Director Jamie Wright said, "We have been overwhelmed with the support from all sectors of the market for our Capital Raising, including from institutions, sophisticated investors and existing shareholders.

To be able to secure support from a lithium industry participant with the credibility of Yibin Tianyi is a strong vote of confidence in our Company and we look forward to developing our relationship with them over time.

The Capital Raising funds provide us with the ability to ramp up our activities on site as we seek to grow our project and we are looking forward to a busy 2022 period.

Drilling is continuing at our MBLP and we will update the market as we start to receive results.

We would like to thank existing shareholders for the ongoing support."

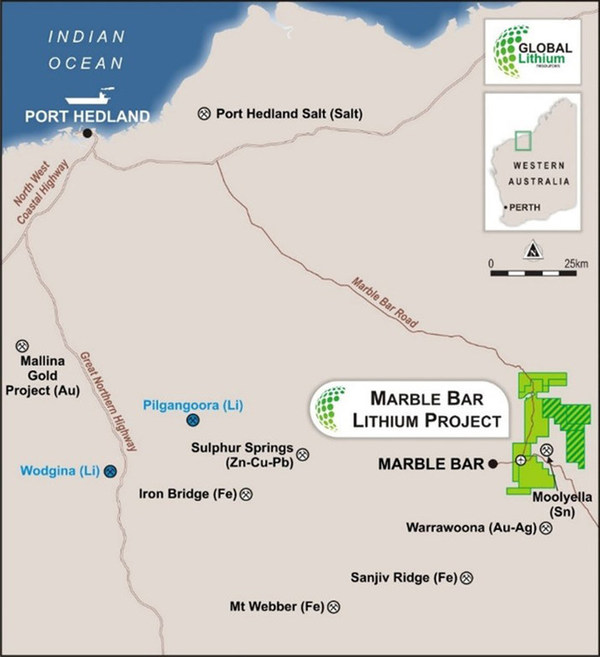

The MBLP is situated close to major road infrastructure, with direct links into Port Hedland, where bulk commodities, including spodumene concentrate, are currently being exported (Figure 1). The MBLP is also located approximately 15km from the town of Marble Bar, which provides ready access to services and skills.

Overview of Yibin Tianyi

Yibin Tianyi is a lithium hydroxide producer that operates as a joint venture between Suzhou TA&A Ultra Clean Technology Co. Ltd (SZSE: 300390) (68%) and CATL (SZSE: 300750) (25%). CATL is the world’s largest EV battery producer.

Yibin Tianyi is the largest supplier of lithium hydroxide to CATL and operates a 20ktpa lithium hydroxide plant in Yibin, Sichuan province. Yibin Tianyi plans to commission a further 25ktpa of capacity by the end of 2021, a further Stage 3 expansion for 110ktpa by the end of 2024, making them one of the largest lithium chemical suppliers in China.

Global Lithium and Yibin Tianyi look forward to working together in the future to grow the business, including in the areas of exploration, business development, potential offtake and project development support.

Approved for release by the Board of Global Lithium Resources Limited.

Competent Persons Statement:

Information on historical exploration results and Mineral Resources presented in this Announcement, together with JORC Table 1 information, is contained in the Independent Geologists Report within the Company’s Prospectus dated 22 March 2021, which was released as an announcement on 4 May 2021.

The Company confirms that it is not aware of any new information or data that materially affects the information in the relevant market announcements, and that the form and context in which the Competent Persons findings are presented have not been materially modified from the original announcements.

Where the Company refers to Mineral Resources in this announcement (referencing previous releases made to the ASX), it confirms that it is not aware of any new information or data that materially affects the information included in that announcement and all material assumptions and technical parameters underpinning the Mineral Resource estimate with that announcement continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons findings are presented have not materially changed from the original announcement.