Commodities | Sep 13 2007

By Rudi Filapek-Vandyck

Spot gold may retreat in the next few trading days, as one would expect after such a strong performance as in the past two weeks, but the outlook for the gold price remains up, up and up, many a market watcher acclaims.

Amongst the cited supportive factors are the fact that the latest price surge has taken gold above (previously strong) resistance levels, not only in USD but also in several other fiat currencies, and the widespread expectation that the Federal Reserve will soon announce its first rate cut post the global liquidity squeeze. This should send the US dollar lower, and thus spot gold higher.

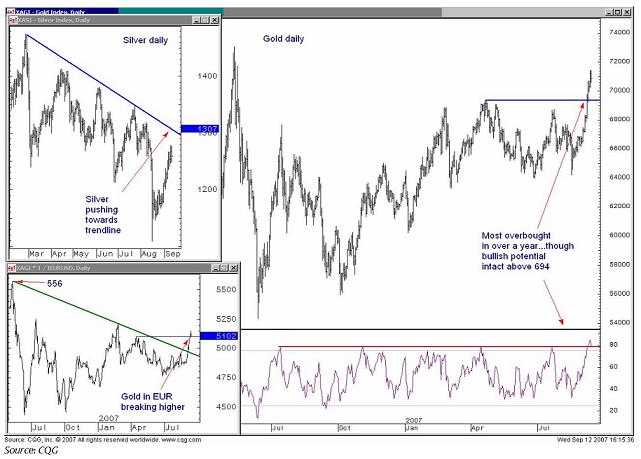

The only negatives, or so it would seem, is that every gold trader and his dog seems to be long at the moment, while technical indicators have started to flash overbought market momentum. But it’s hard these days to find anyone who doubts the upside potential for the precious metal.

US based trading guru Dennis Gartman wouldn’t add to any positions, though, as he prefers to wait for the pullback which he expects will take gold back to around US$700/oz.

Technical chartists at Barclays Capital believe the aforementioned pullback may well take gold back to below the US$700/oz price level, but they agree with the overall positive sentiment.

The chartists believe that as the metal is expected to hold its ground above US$695/oz it should soon start targeting US$730/oz, with the next target at US$800/oz.

While most market commentators believe gold’s little brother, silver, is likely to follow in big brother’s foot steps, Barclays chartists suggest this may not necessarily be the case as their charts indicate spot silver is approaching key technical resistance whereas for gold the gates appear to be open for higher highs.

Earlier this week, precious metals specialists at Credit Suisse said they preferred gold and platinum above silver and palladium due to several key differences in specific market dynamics. Both silver and palladium are believed to be in a supply surplus environment.

While that may be true, for the moment, commodities specialists at RBC Capital have reiterated their ongoing positive view for silver market dynamics, and the price for the metal, in the years ahead. In line with its positive market view, RBC analysts believe investors in global share markets have started to value silver companies too cheaply.

RBC Capital maintains global demand for silver will continue to outpace new mine supply, while increases to industrial and investment segments of global demand are expected to more than offset continued declines of silver usage in the photographic industry.

RBC’s average price forecasts for silver are currently US$12.75/oz for 2007, US$13.00/oz for 2008, and US$13.50/oz for 2009.