Commodities | May 27 2008

By Chris Shaw

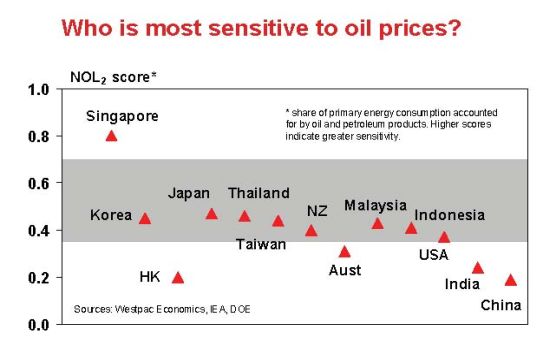

Higher oil prices hurt consumers not only because of higher fuel prices but because of higher prices for goods generally, given the impact of variables such as higher transport costs, but as Westpac senior international economist Huw McKay points out, the impact of higher fuel costs is different for different countries depending on the level of their negative oil leverage.

McKay explains this negative oil leverage measure as being designed to show how important oil is in terms of a country’s total primary energy consumption, meaning it takes into account alternative sources of energy within that country’s economy and via trade. In simple terms, it is a measure of who has diversified by fuel source and who hasn’t.

The bank has updated the measure to make it even more relevent by including additional factors such as is the case in Singapore where the country is a major importer of crude but a large refiner and exporter of petroleum products. This impacts on its negative oil leverage score, as on the old basis it would be at 350% but adjusted it is only 80%, which implies the impact on the country is less severe than the previous measure would have indicated.

Using data from many years McKay notes in terms of the revised negative oil leverage score the greatest reductions occured in the mid to late 1970s, which coincides with the original oil price shocks of that period. Since then most G7 nations have posted scores of 33%-45% on average, which suggests some level of diversification of fuel sources.

In contrast the historical data shows Brazil has made little headway in diversifying its fuel usage, while Russia enjoys a low dependence on oil given its broad base of doemstic reserves and Saudi Arabia remains almost entirely dependent on oil for its fuel needs.

Moving to the present, the data shows the most significant implications are likely to be felt in the Asian region as Japan, Korea and Taiwan all have scores above OECD and world averages, implying they will feel the impact of higher fuel prices more strongly than might other nations.

Australia scores relatively well, its revised negative oil leverage score of 31% for 2005 being an improvement from the 33% score in 2000, and further progress from the 36% achieved in 1960.

India and China have quite low scores but while these are from low bases McKay also points out it is because both countries rely on coal for most of their energy generation needs and both are relatively under-developed in terms of the level of car ownership and usage when compared to more developed nations.

While this sounds like a positive there are implications, as McKay notes the reliance of both nations on coal is not helping at present given coal prices are also pushing signficantly higher. This means they will both still feel the impact of higher fuel prices even though they have diversified somewhat.

As McKay sums up, in the current environment there is simply nowhere to hide, meaning at some level of another every country in the world is going to feel the impact from higher prices across the energy complex.