Commodities | Apr 24 2009

By Rudi Filapek-Vandyck

Quite a few eyebrows were raised during the recent rally for global equities which caused gold’s price direction to turn negative and technical chartists subsequently re-assessing their views. A few chartists started mentioning US$730/oz as the next logical target for gold prices, which is exactly what moved eyebrows across the globe. Gold has been trading on both sides of US$900/oz in past weeks. How could this US$730 target be real? Wasn’t gold supposed to be the ultimate carrier of value in uncertain times like these?

One research report that probably has travelled several times across the globe since last week is a technical analysis update by technical market analysts at Dresdner Kleinwort Benson. The reason for this is simple: it is one of the strongest proponents of the new US$730/oz price target for gold.

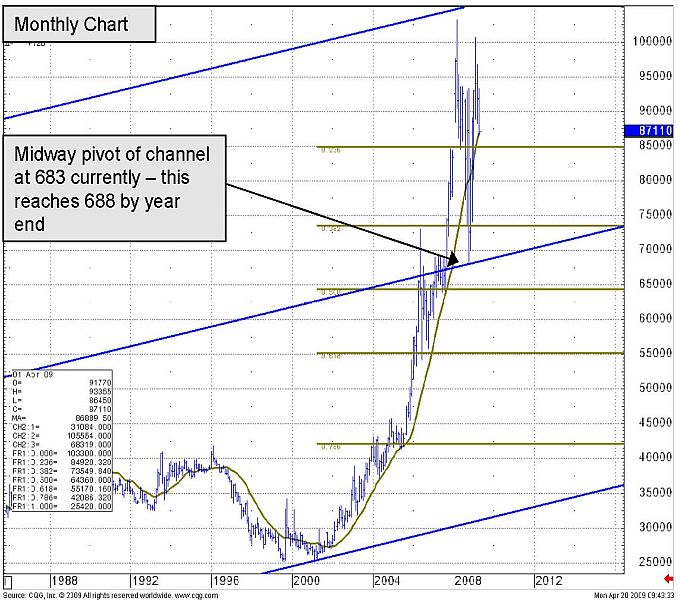

The Dresdner report argues the March-April reversal in price trend for gold has damaged the precious metals’ five year long (20 quarters) established trend. In addition, the precious metal has now failed at the top of a 37 year old trend channel.

It proved enough for the analysts to revise their price outlook, now anticipating gold will gradually break down to reach US$735/730/oz in twelve months from now. The analysts explain the new target as this is the 38.2% retracement of the entire bull move from 2001 and the May 2006 peak. From current levels of around US$870 (the report was published prior to the move upwards over the past days) this translates roughly into a 15.5% drop in price, say the analysts.

“Is this a reasonable forecast?” the reports asks rhetorically. The answer: “Yes – the previous fall from the [US$]1033 peak charted in March 2008 to [US$] 680 took only 6 months, and represented a fall of 34%.”

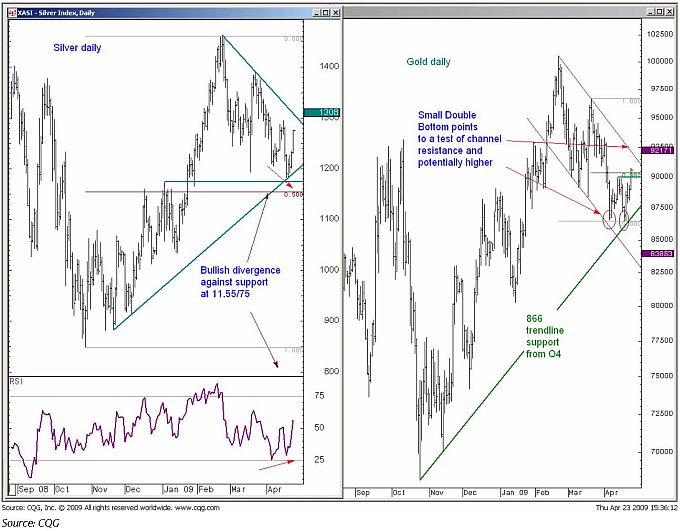

Not everyone agrees with this view. Technical analysts at Barclays Capital, for example, simply refused to abandon their bullish bias during recent price weakness for gold, all the while sticking to their longer term view the precious metal remains untimately on its way to US$1200/oz. Yesterday’s surge to US$904/oz has again triggered bullish comments from their part.

Say Barclays analysts: “The break above [US$]900/904 has changed our outlook, and we are now bullish in the short term. Having bounced from a multi-month trendline near [US$]866 earlier this month, the recently completed Double Bottom implies gains to channel resistance near [US$]921 and potentially [US$]933. Back below [US$]888 is needed to alleviate the bullish risks and suggest a choppier rise than we currently expect.”