Commodities | Jan 31 2008

By Greg Peel

Calculating the amount of gold sold by world central banks in any given year is not an exact science. Nowhere is the information correlated and made publicly available. While some central banks are happily open about their activities, others are camera-shy. Nevertheless, Gold Fields Mining Services has a shot at it each half year. The results are only estimates, which GFMS admits are garnered through a combination of publicly available information and “field research”. As the release of information can come with a considerable lag, GFMS often updates its numbers through the course of the year.

That’s the first thing to consider.

The second thing to consider is that whatever GFMS comes up with in its estimates, the numbers will always be questioned by an organisation known as GATA. In short, GATA believes there’s a lot more clandestine activity going on in the central bank gold market than GFMS would ever discover by its normal means. GFMS dismisses the members of GATA as a bunch of crazy conspiracy theorists. To learn why GATA might question the numbers appearing in the following report refer to “GATA Set To Drop A Golden Bombshell” (Commodities; 30/01/08).

Moving on.

GFMS estimates official sector (central bank) gold sales to have reached 488 tonnes in 2007. This is about 100 more tonnes sold than in 2006, and as 2007 progressed the jitters were put through the gold market every time more sales were announced. At the outset of 2007, the market was expecting only similar sales to 2006, at the most. But in the period of March to May it seemed reports of further central bank sales would never end. This is the period in which the gold price kept trying to break US$700/oz, but failed time and time again. Official sales were one of the main reasons a wall was erected. That the wall eventually vanished is one of the reasons we’re now up over US$900/oz.

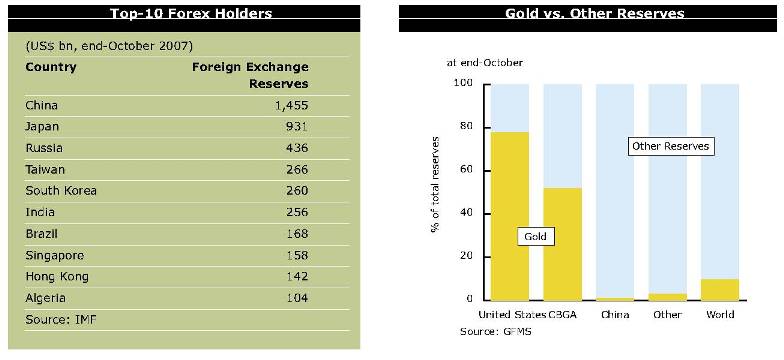

About 94% of last year’s gold sales came from the Central Bank Gold Agreement countries, which include most of Europe. The third year of the second CBGA ended in September 2007. The first and second CBGA’s were set at five-year periods. The rule is that in each CBGA year, the combined official sales of the signatories cannot exceed 500 tonnes. It is still not a given there will be a third CBGA. The original agreement was signed in Washington and as such the CBGA is also known as the “Washington Agreement”. Clearly the CBGA is a dominant force in the gold market, and thus forecasts of total official gold sales revolve very much around what is going on in Europe.

It is not surprising when you realise that after the US at number one (8.1kt), the next four places on the list of greatest central bank gold reserves are filled by Germany (3.4kt), France (2.6kt), Italy (2.4kt) and Switzerland (1.1kt). Then you hit Japan. The rest of Europe is pretty much accounted for throughout the Top 30. Australia, one of the world’s biggest gold producers, doesn’t even make it into the Top 30 (even Thailand is at 30), having dumped most of its gold at the bottom of the market. The UK, which famously sold half of its reserves deliberately at the bottom of the market in 1999, still reaches number 14.

The biggest seller in the CBGA last year was Switzerland, at 45 tonnes. Switzerland is a happy discloser, announcing last April it would steadily and calmly sell 250 tonnes by the end of this agreement. The reason given was simply that the Swiss central bank had set a proportional target of the value of gold within its total foreign exchange (gold is considered a currency) reserves, and as the gold price had risen that target had now been exceeded. With gold up here one presumes there’ll be more selling to come down the track.

The next biggest seller was Spain, it would appear. The Spanish story is vastly different to that of Switzerland, with the country undergoing a current account crisis. Spain sold 110 tonnes between March and May and a further 25 tonnes in July. It is far from out of the woods.

GFMS suggests the closely guarded French reserves appear to have fallen by 96 tonnes through the course of the year. Like Switzerland, France has revealed a steady selling program.

Thereafter, Austria and Sweden sold 9 tonnes each while Germany sold 5 tonnes. Germany has decreed it will hang on to its gold except for the purpose of minting coins. An other or others in Europe then sold a total of 20 tonnes.

Another seller of gold is the Bank for International Settlements, but not even GFMS can get hold of this information. It will, however, be made public in its annual report coming out later this year.

On the buy side, purchases reached an estimated 64 tonnes. GFMS knows of two of these buyers, but is not at liberty to reveal them. Other than that, Qatar and Kazakhstan were both small buyers.

Traditionally, central banks are keen lenders of gold, given they own most of it (not including what has been fashioned into jewellery, which is at least three quarters of all the gold ever found). Lending (or “leasing”) is usually undertaken to cover the activities of investment banks who offer hedging services to gold miners. Since gold started running from about 2004, demand for gold hedging has been steadily dropping off as miners unwind and position themselves to fully benefit from rising prices. Moreover, the slashing of US interest rates last year means the return on gold leasing barely covers the cost of storage, so in 2007 leasing rates were very low and activity minimal.

A lack of gold leasing is bullish for the gold price as it means less spot market selling.

So what will 2008 bring?

In short, GFMS expects 2008 official gold sales to more resemble 2006 than 2007. Switzerland will keep going as indicated, as will France, most likely. Austria and Sweden will maintain small sales while Germany will remain on the sidelines. The Netherlands appears to have finished for now, and it is unlikely Spain will go again. A big contender is always Italy, given the extent of both its government debt and its gold reserves. But as gold sales would not make much of a dent in the debt, GFMS does not expect Italy to be a seller.

Outside of the CBGA, GFMS expects sales and purchases to largely net out. Purchases will probably occur as a result of some countries’ desire to diversify out of US dollars, but shouldn’t make a big impact. Gold leasing rates will remain low, as will hedging demand, at least for now.

There is a risk that if the gold price continues to fly, more opportunistic sales could emanate from the CBGA. However, at this point GFMS sees first half 2008 sales at around net 200 tonnes, which is less than the same time in 2007.

The way is thus clear. US$1000/oz here we come?