Daily FNArena News - International

All | Australia | Book Reviews | Commodities | ESG Focus | FYI | International | Small Caps | SMSFundamentals | Technicals | Treasure ChestLatest Stories

Yesterday’s Champions are today’s punching bags and vice versa. Stephen Auth, Executive Vice President, Chief Investment Officer, Equities at Federated Hermes explains why and why this process isn’t over yet

10:30 AM

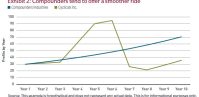

Investors always get excited by Cyclicals experiencing a Boom period. MFS Investments’ Robert Almeida explains why longer-term strategies might be better served by owning Compounders instead

Jan 20 2026

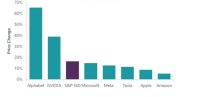

Despite bubble fears, there are several key differences between the late 1990s and today that bode well for US equities in the year to come, ClearBridge Investments reports

Jan 19 2026

![]()

Ongoing AI development is creating a supply shock that simply cannot be circumvented or avoided in 2026, GenInnov CEO Nilesh Jasani explains

Jan 15 2026

Latest News

| 1 | Rudi Interviewed: February Is Less About Earnings4:49 PM - Rudi's View |

| 2 | FNArena Corporate Results Monitor – 12-02-20262:01 PM - Australia |

| 3 | Australian Broker Call *Extra* Edition – Feb 12, 20261:26 PM - Daily Market Reports |

| 4 | The Short Report – 12 Feb 202611:00 AM - Weekly Reports |

| 5 | A Healthy Correction Underway10:30 AM - International |