Technicals | Nov 18 2006

It has caught John Bedson’s attention that an increasing number of market strategists and commentators, including your editor, has been warning Australian equities are getting expensive. John manages his own hedge fund and is an avid reader of FNArena. Earlier this year he tried to set up his own financial chatroom webservice, but he has abandoned the idea.

John communicates with several of the finest minds in the Australian financial market on an irregular basis. This week John and your editor exchanged a few emails from which this story has been derived.

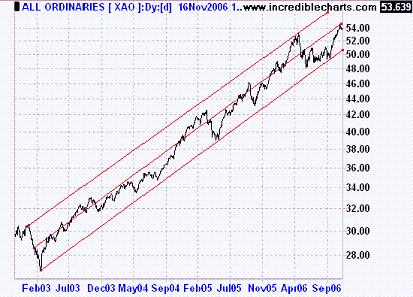

Using technical analysis, John is of the view that Australia’s All Ordinaries index has reached the top of a long term trading range. He is adamant this does not equal the top of the current bull market. These conclusions are drawn from the two charts displayed below.

Assuming John’s analysis is correct, this would assume the Australian share market could be about to “break out” which would take it above its long term range to form a blow-off top and subsequently crash just like happened back in 1987.

But investors be warned, says John, the above scenario does not mean get out of this market as fast as you can. Blow off tops can be extremely profitable in a very short space of time, John says. And make no mistake about the term “short” either as it might mean six months to a year, he explains.

Taking a look at the “expensive equities” matters from a broader economic perspective, John believes the odds are in favour of soft landings for both the economies in the US and Australia. This should be very positive for equities, he says.

John has another chart up his sleeve which should shush any deep concerns about the market correcting in a big way anytime soon. Consider the chart of the US treasury ten year yield, says John, adding it broke out of its “triangle” southwards this week for the first time.

Assuming this trend will continue, investors will be confronted with lower interest rates in both the US and Australia over the next year or two. John believes this is likely “to suck cash into equities for the higher yield compared to fixed interest”, further underpinning his case for ongoing strength in equities.

On Friday, he added a fourth chart to the thesis stating “This chart makes it even clearer what is happening”.

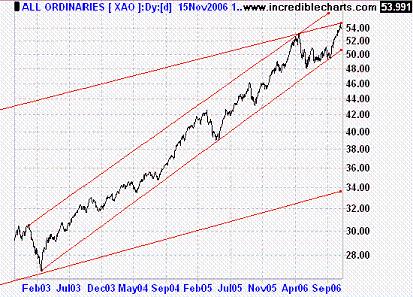

The log chart of the past four years clearly reveals the May 2006 high rebounded from the upper trendline of this bull campaign, John explains, pointing out the market bounced off the support of the lower trendline. It then rose to the centre line and rebounded again.

He believes that with the end of year rally approaching, this must be a short, shallow countertrend, caused by metal and oil price weakness. John believes the next move “should be to rise steeply through the centre line and hit the upper trendline about Christmas/end of January. It should then correct again. That will mean a target of approximately 5,800/6,000 on the XAO, which will about an 8% gain in about 8/12 weeks.” (XAO simply refers to the All Ordinaries.)

Placing the matter again in a broader economic framework, John argues the economy is landing softly with employment and wage increases remaining strong. What this means, he says, is that high levels of debt are “quite okay” and can even be increased. He adds that falling property prices can also be a benefit to the economy, as new buyers pay less and thus have more to spend on other things. Falling fuel prices will also lift the economy.

“I continue to think that the boom lies ahead, not behind us”, John maintains. One of the reasons for this belief is that price earnings ratios over the past few years have been lagging and trying to make up for faster running company profits.

In effect, he says, rising profits have matched rising equity prices. That is not a “boom”, that is flat-lining. When valuing the share market investors should always look at relativity, says John. He adds: “relative to profits, shares have gone nowhere”.

John says this is a global phenomenon. Ultimately, all these excess corporate profits come from the exploitation of Asian workers who are being employed for remuneration that is substantially below global averages. This has lifted Western living standards to a greater extent than Asian living standards.

John believes it’s best to look at contemporary times in terms of a globalisation boom rather than just a commodities boom. He is quick in adding this globalisation boom has not even entered its manic stage yet.

Such a manic stage, he believes, could lift the All Ordinaries index to 12,000 in a relatively short space of time.