Commodities | Apr 22 2008

This story features SANTOS LIMITED, and other companies.

For more info SHARE ANALYSIS: STO

The company is included in ASX20, ASX50, ASX100, ASX200, ASX300 and ALL-ORDS

By Greg Peel

UBS today lifted its 2008 average oil price forecast to US$86.96/bbl. At the last monthly Reuters price poll, UBS was hanging on to US$74.00. Such a price seems but a distant memory. Yet US$86.96 also implies a significant fall in the oil price from US$117 for 2008 to ultimately see such an average. At no time in 2008 to date has the price been under US$90.

The truth is that oil analysts have been expecting a pullback towards US$80 for some time now. And let’s face it – such a prediction makes perfect sense. The world’s largest economy (by far) is undergoing a significant contraction, some might even say a recession, and on that basis the demand/supply fundamentals simply have to favour lower priced oil.

At the same time the world has been madly, madly rushing to explore for more oil, expand existing wells and fields, flush out old wells, drill deeper and deeper, trek further and further into the wilds – in short, with such high prices the old adage of supply increasing to meet demand is in play. But still we’re achieving ever new record highs. It is a conundrum.

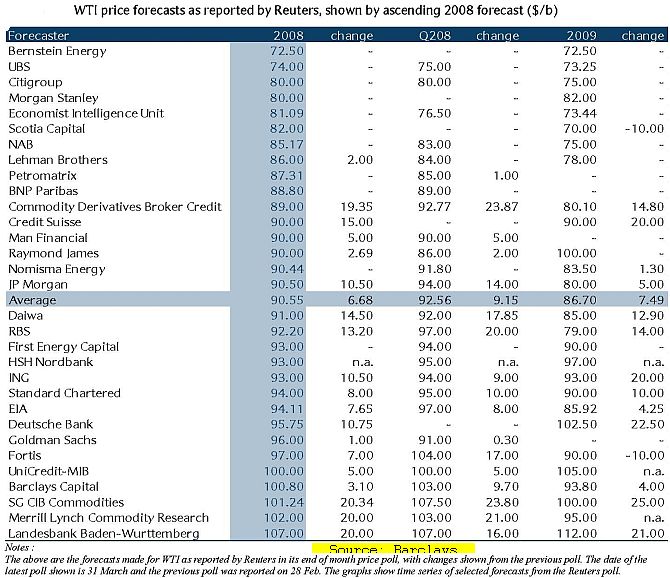

It is this conundrum which explains the following table:

The Reuters price poll of oil analysts is conducted every month, and what is most striking is firstly the US$72.50-107.00 range of 2008 averages which gives a mean of US$89.30 – 24% below last night’s close of US$117.48. What is equally striking is the accompanying list of revisions to even get to that mean. Some are quite material.

High on the list is Barclays Capital at US$100.80. The small revision to get Barclays to that point is testament to the fact the Barclays analysts have been far more bullish than the pack for some time. They have their own spin on the reason for higher oil in the face of US economic slowdown, but let’s consider some possible superficial explanations. They might include:

(1) A weak US dollar;

(2) Ongoing geopolitical tensions;

(3) China and the car;

(4) The soaring cost of oil production.

In the case of (1), note that when gold traded at over US$1000/oz last month oil was at around US$105/bbl. Gold is supposedly the most closely correlated to the US dollar but it’s now at US$916 and oil is at $117. The US dollar has been relatively steady this last month.

As for (2), well yes – the latest is more Nigerian sabotage and if it’s not that it’s ranting from Iran or more trouble in Iraq or Venezuela trying to throw its weight around. But you can just about imply a geopolitical tension premium permanently, which is part of the reason we’re at US$117 and not US$57, and not a lot to do with why we’re not at US$87 by now.

(3) is a reality, and this is really a metaphor for developing world economic growth and subsequent oil demand growth in general. Those remaining bullish of oil put their views down to this factor most decisively, usurping any demand fall due to a weaker US. This relies on the “decoupled” theory, and one must remember that the US economy is far, far larger than that of China’s, which in turn is very large among its developing peers.

As for (4), Barclays’ analysts note this has become a popular explanation. Yesterday Australia was granted leave to expand its territorial waters for mining purposes, yet treasurer Wayne Swan noted the obvious that no one can get hold of a spare offshore oil rig at the moment anyway. The scarceness of equipment and labour has helped push the cost of producing oil through the roof, and as such there must be a flow on to the clearing price of crude.

But Barclays does not agree. Say the analysts, “Marginal costs have never really served as a useful explanatory tool for price dynamics, as the economics of the oil market do not (and have not since the 19th century) involve price-setting at the margin of the market by high-cost producers”. In other words, the high cost of new projects does not set the flow-through price for all production. There is plenty of lower cost legacy production still going on (look at Saudi Arabia for example).

Barclays puts its whole bullish view down to the weakness of non-OPEC supply growth – not the higher cost. OPEC production is relatively well known, given the organisation provides regular quota updates. Everyone has been anticipating that OPEC would increase production at these higher prices given (a) it says it has years and years of oil left and (b) it is not in the interest for OPEC to kill demand via crippling energy costs for the developed world. But OPEC hasn’t increased production, nor does it appear likely to.

OPEC has argued that the price is about right (in Iran’s case, too low) despite ongoing expectation of a US and perhaps a global recession. But we know for sure that OPEC never sticks to their quotas anyway (each country “secretly” produces as much as they can) and many suspect it couldn’t actually increase production if it wanted to – it is running out of oil. This would easily explain why OPEC doesn’t want to lift its quota – it simply can’t.

Non-OPEC production forecasts are, however, a bit of a guess and giggle affair. Barclays admits that it has been surprised by the contribution from Russia, which at the beginning of the year the analysts predicted would prove the second most important source of non-OPEC supply growth in 2008 to Brazil. But for the last thee months Russian production has been falling, not rising. This weakness could yet prove “extremely significant and problematic”, says Barclays. The analysts believe consensus predictions are likely to dramatically overestimate the ability of non-OPEC supply response to provide a brake on rising prices. To that end the analysts suggest:

“In our view the drift up in prices, and the continuation in the reduction of resistance to higher prices along the [forward] curve, are still very much a function of perceived imbalances into the future. If we are correct in our view that non-OPEC supply will be at best very weak in 2008, and is likely to fall, despite a decade of rising prices, the impact on perceptions of the long-term clearing price is likely to be a powerful one, and likely to be more powerful than any perceived position in the short term economic cycle.”

Translation: Forget about a brief US recession – it’s all a matter of waning supply. Barclays suggests we will yet see a higher oil price in 2008.

That is not to say there will be no effect on demand. Barclays notes the International Energy Agency was predicting back in August that first quarter global demand would rise by 1.57mb/d. The most recent projection is now for a fall of 0.19mb/d. What this tells Barclays is that the IEA – whose forecasts are probably the most closely watched – has its own guess and giggle problems, and that if the agency’s August forecast was right oil would be well over US$130 by now. So anticipated demand reduction may be with us, but the supply side is where the problem lies. It has become surprising how each week when the official US inventory figures are released the market almost always now expects a rise, and almost always gets a fall.

Barclays suggests that the table above will look different again next month, as more and more analysts ratchet up their oil price forecasts just as UBS did yesterday.

Does this mean investors should be buying up oil producers in anticipation of these forecast increases? Not necessarily. As one can no doubt note most analysts have been behind the curve, not in front of it. It’s only a catch-up. Oil producer share prices not only run up with each incremental increase in the spot price, commodity producer share prices always outperform their underlying commodity price (and vice versa on the downside).

UBS analysts lifted their 12-month targets for oil producers mostly from below the market to above it, yet they are retaining a Neutral rating on Woodside ((WPL)) and Santos ((STO)), and downgrading both Australian Worldwide Exploration ((AWE)) and Tap Oil ((TAP)) from Buy to Neutral.

The analysts retain Buy ratings on Oil Search ((OSH)), Beach Petroleum ((BPT)) and Roc Oil ((ROC)) with a Sell on AED Oil ((AED)).

Click to view our Glossary of Financial Terms

CHARTS

For more info SHARE ANALYSIS: BPT - BEACH ENERGY LIMITED

For more info SHARE ANALYSIS: ROC - ROCKETBOOTS LIMITED

For more info SHARE ANALYSIS: STO - SANTOS LIMITED