FYI | Jan 22 2010

This story features WOOLWORTHS GROUP LIMITED, and other companies.

For more info SHARE ANALYSIS: WOW

The company is included in ASX20, ASX50, ASX100, ASX200, ASX300 and ALL-ORDS

By Andrew Nelson

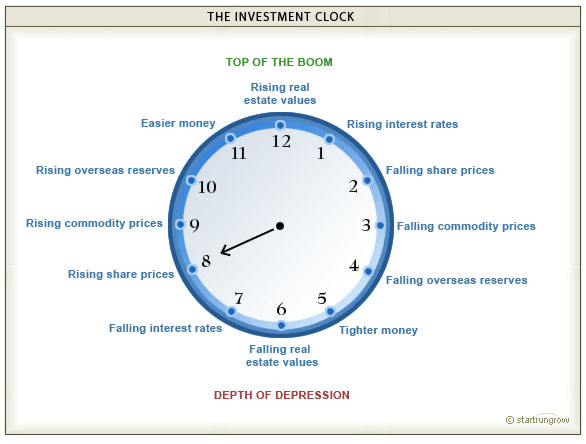

From its birth in 1937, the investment clock has been one of the better known indicators of the state and likely direction of finance, property and equities markets. The clock shows the cyclical movement of markets within a ten-year cycle and can provide a useful insight as to the direction of the investment environment.

One of the things the investment clock does best is to show the cyclical relationship between investment in different asset classes such as shares, property and fixed interest. More importantly, it shows the order in which they all occur. It’s important to note that it’s not a very useful indicator for predicting the timing of various trends in the market, rather its purpose is to indicate in what order things will happen, allowing an investor to position assets accordingly.

Thus, the clock tells you when it’s time to move from investment medium to another by taking into account the prevailing indicators such as interest rates, commodity prices and inflation. A good example is how it shows that the share cycle is followed by the real estate and then the fixed interest cycles.

Now let’s take a look at the last few hours.

At the beginning of the last quarter the RBA started to lift interest rates indicating the beginning of a tightening policy. In investment clock terms, this is the opposite to the 8:00 position. However, we need to bear in mind that we were coming off a very expansionary base on the back of some major stimulus that was enacted to counteract the GFC.

Over the course of the quarter, the RBA lifted rates three times, pushing the cash rate target to 3.75%. This was an unprecedented move by the RBA, which had never before lifted rates three times in a row. Yet while the research team at Perth stockbroker DJ Carmichael is of the opinion that there is a good chance the RBA will lift rates again in February, they feel it will be in an effort to establish a median trend in rates. It will not result in tight policy.

The team notes that housing data, in terms of volume and price, were strong during the quarter, with evidence continuing to emerge that interest rate rises to date, coupled with those that are expected in the early parts of 2010, are starting to have a crimping effect. The intent, of course, is to reduce demand and keep the sector within limits.

Commodity prices were also on the rise over the last quarter. This was especially so for copper, a key metal. Prices rose from around US$6,136 per tonne to US$7,346, but then pretty much all LME traded metals had a reasonable run. Share prices of the miners and industrials that produce the underlying metal commodities also performed strongly.

With a divergent range of factors affecting the position of the economic clock, DJ Carmichael sees it simply as evidence that different economies are at different stages. As evidence, the market strategists point out the stark contrast between China and Australia with Europe and the US. And with overseas reserves in most of the developed world increasing at a very slow pace, and with lending policies still tight, “perhaps”, says the team, 9:00 is a fairly reasonable place to be sitting.

Looking at China by itself, with a red hot real state market and tightening lending practices fast on the heels of a period of very easy money, and that economy on its own is probably sitting closer to 12:30, the team reasons.

In the year ahead, DJ Carmichael sees the market being supported over the first half by continued confirmation that the domestic and global economies are recovering. Liquidity is high, growth is rebounding, recapitalisation of balance sheets is largely complete and consumer and business sentiment has improved considerably. This has the broker recommending a weighting toward cyclical stocks in the near-term.

The broker’s sector strategy over the next quarter is to stay overweight resources and financials, and with banks particularly leveraged to the health of the domestic economy, they probably stand in the best position to profit from rising lending rates, while remaining insulated from the strong AUD. The team is also a big believer in the China/India growth story and thus in the near term expect to see continued strength in the resources sector. This will be buoyed by improving levels of risk appetite and growing confidence in global economic recovery.

This trend will also be positive for commodity sensitive currencies, like the AUD, although a stronger AUD will admittedly offset at least some of the impact of higher commodity prices. Lastly, the team sees capex intensive industries and housing construction as continuing to advance over the first half of 2010.

DJ Carmichael has singled out three stocks worth looking at in the context of a 9:00 read on the Australian investment clock. Bradken ((BKN)), which has a large market share in mining and rail equipment, is labelled by the broker as a low margin, capital intensive cyclical, which should do well on the increasing mining and rail activity that the broker expects to see in the next few years. The stock is rated Accumulate by DJ Carmichael.

Woolworths ((WOW)), with its solid balance sheet and an “imposing moat surrounding its economic castle” is also in a position to do well over the next few years. The broker rates it a Buy and is also a fan of the company’s move in to the hardware retailing space, predicting Woollies will be successful in taking market share from Bunnings ((WES)).

Last on the short list is Westpac ((WBC)), with the team citing the bank’s balanced exposure to the retail, corporate and institutional sectors. With benefit from rising lending rates over the course of 2010 soon to hit the bottom line and with Commonwealth Bank ((CBA)) recently providing a bullish 1H10 guidance, the broker sees plenty of upside for Westpac.

The team notes that Westpac has the closest business mix to CBA while trading on lower multiples, implying there’s more value at this point in time. The stock rates a Hold.

Click to view our Glossary of Financial Terms

CHARTS

For more info SHARE ANALYSIS: CBA - COMMONWEALTH BANK OF AUSTRALIA

For more info SHARE ANALYSIS: WBC - WESTPAC BANKING CORPORATION

For more info SHARE ANALYSIS: WES - WESFARMERS LIMITED

For more info SHARE ANALYSIS: WOW - WOOLWORTHS GROUP LIMITED